The News: Salesforce Q1 2023 earnings figures were reported May 31, with the company bringing in $7.4 billion in revenue, a 24 percent increase from the same quarter one year ago, amid sales increases for subscriptions and professional services. Salesforce also reported remaining performance obligation of about $42 billion, including current remaining performance obligation for Q1 of about $21.5 billion, up 21 percent from a year ago. Read the Press Release from Salesforce.

Salesforce Q1 2023 Revenue Up 24% YoY as Subscriptions Gain

Analyst Take: It was another positive fiscal quarter for Salesforce revenue growth, but even more notable is that its performance obligation balance remains healthy, indicating a steady stream of sales and revenue to come for the company.

Here are the Salesforce Q1 2023 results by the numbers:

- Q1 2023 revenue of $7.4 billion, up 24 percent from $5.9 billion one year ago. This beat analyst consensus estimates of $7.38 billion, according to Yahoo Finance.

- Non-GAAP net income of $982 million, down 13.9 percent from $1.1 billion one year ago.

- Non-GAAP diluted net income per share of $.098 cents per share, down 19 percent from $1.21 per share one year ago.

- Remaining performance obligation of $42 billion, an increase of 20 percent from the same quarter one year ago.

- Current remaining performance obligation ending Q1 at $21.5 billion, an increase of 20 percent over the same quarter in 2021.

For Salesforce, the latest financial results continue to mark an extended period of growth for the CRM juggernaut, and we expect that growth to continue based on the performance of its product portfolio and experienced leadership team.

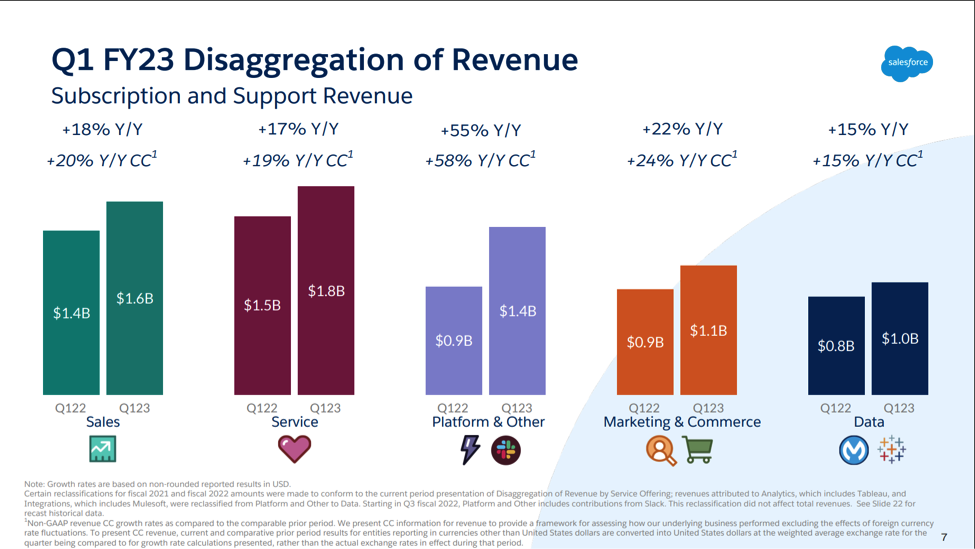

The Salesforce Q1 2023 numbers show that the company is continuing to fire on all cylinders, with subscription and support revenue growing to $6.85 billion, up 23.8 percent from $5.5 billion one year ago, and its professional services and other revenue growing to $555 million, up 30 percent from $427 million one year ago.

Salesforce does a nice job of breaking down its businesses across segments, which has been updated to include new categories over the past few years. Platform has been a growth engine for the company as its other categories have shown an impressive, yet steady, growth rate. The core businesses (Service, Sales Cloud) have been performing well as they mature. The data businesses grew a bit slower than I would have expected as these big inorganic bets are likely expected to grow faster. However, we do believe the long tail on these segments is positive in both extending customer revenue and enabling scale for the Salesforce Platform.

By region, Salesforce Q1 2023 revenue totaled $4.97 billion in the Americas, up 21 percent from $4 billion in 2021; $1.7 billion in Europe, up 33 percent from $1.3 billion in 2021; and $702 million in Asia Pacific, up 23.8 percent from $567 million one year ago.

These are good results and healthy growth, which is indicative of a continuing positive direction and strategy by Salesforce.

Salesforce Q2 and FY2023 Guidance

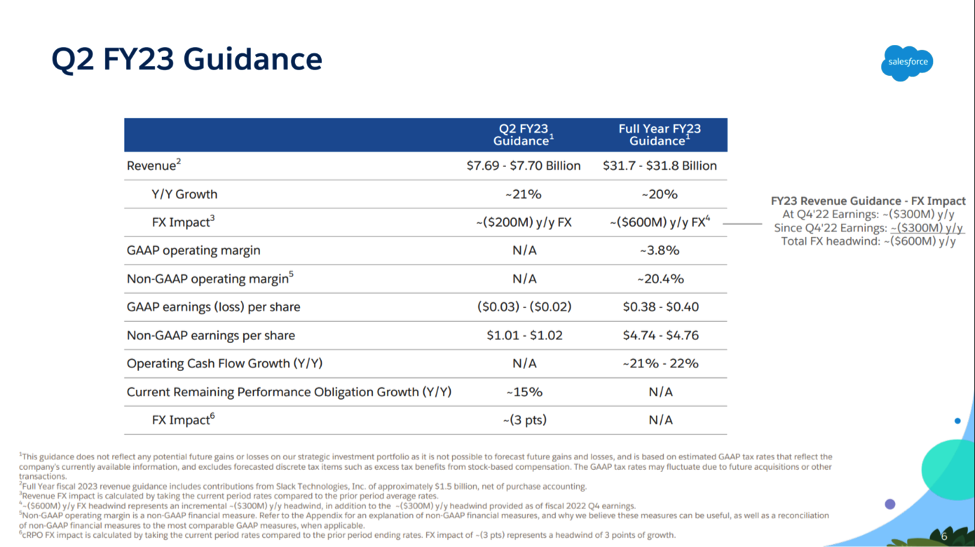

Salesforce also provided guidance for fiscal Q2 and for fiscal full year 2023 as part of its latest earnings report.

For Q2 2023, Salesforce estimates revenue of about $7.69 billion to $7.70 billion, with year-over-year growth of about 21 percent. Salesforce estimates full year 2023 revenue of about $31.7 billion to $31.8 billion, with year-over-year growth of about 20 percent.

Guidance for non-GAAP earnings per share for Q2 2023 is estimated at $1.01 to $1.02 per share, while non-GAAP earnings per share for the full fiscal year are estimated at $4.74 to $4.76 per share.

The company’s earnings growth guidance is encouraging, however, the somewhat light revenue number would be an area to watch for as it seems the company is signaling a possible slowdown, albeit moderate.

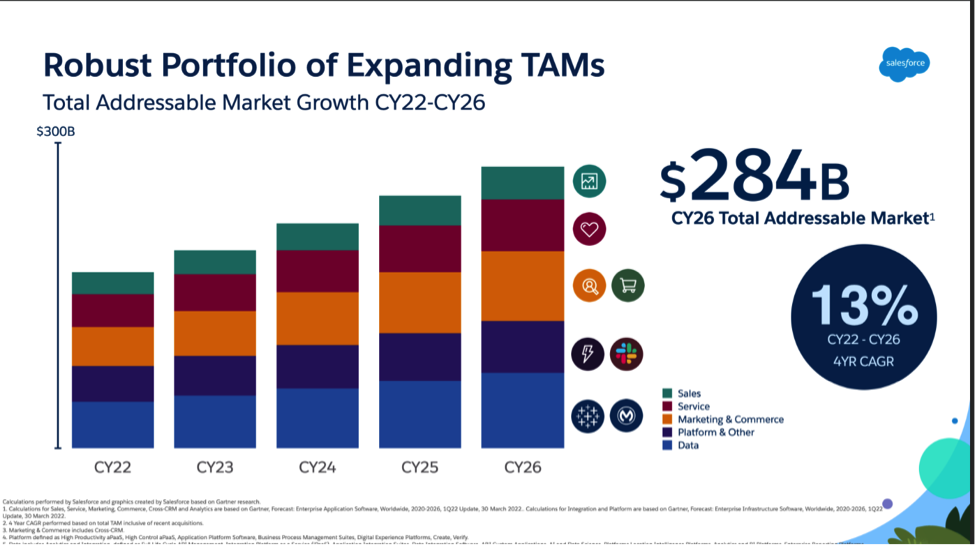

When it comes to Salesforce, we have maintained a largely bullish outlook over the last few years on its continued revenue diversification by moving beyond its core businesses and by the significant investments the company continues to make in its platform—a particularly critical part of the company’s long term growth strategy.

These strengths continue today for Salesforce. The pandemic-inspired move to work from home played a role in Salesforce’s success, as customers were forced to rapidly pivot and speed their digital transformation initiatives, and Salesforce was ready to deliver on all fronts.

It will be interesting to continue to watch the company’s growth in its emerging technology areas like Platform and Analytics to get a better sense of its long-term prospects. At its current trajectory, Platform will become the company’s largest business by segment, and this will serve as a great way to augment the rest of the company’s maturing business lines. Stable growth in the core businesses should be acceptable if its diversified revenue segments continue to accelerate.

Salesforce has transformed itself from a disruptive SaaS growth company into a successful, substantial hybrid of growth and value in the marketplace. This shift is a byproduct of maturing into a category incumbent leader. However, it is still an innovator that is breaking its own revenue records, but it is also a robust recurring revenue machine that is making big bets in its products, services, and acquisitions. In the end, we believe that it would be hard to think these bets will not pay off.

Disclosure: Futurum Research is a research and advisory firm that engages or has engaged in research, analysis, and advisory services with many technology companies, including those mentioned in this article. The author does not hold any equity positions with any company mentioned in this article.

Analysis and opinions expressed herein are specific to the analyst individually and data and other information that might have been provided for validation, not those of Futurum Research as a whole.

Other insights from Futurum Research:

Salesforce to Acquire Troops.ai According to New Signed Agreement

Salesforce Renames Tableau CRM ‘Salesforce CRM Analytics’

Salesforce Safety Cloud Launches, Designed to Streamline COVID Testing and Status Reporting

Image Credit: Software Strategies

The original version of this article was first published on Futurum Research.

Daniel Newman is the Principal Analyst of Futurum Research and the CEO of Broadsuite Media Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise. From Big Data to IoT to Cloud Computing, Newman makes the connections between business, people and tech that are required for companies to benefit most from their technology projects, which leads to his ideas regularly being cited in CIO.Com, CIO Review and hundreds of other sites across the world. A 5x Best Selling Author including his most recent “Building Dragons: Digital Transformation in the Experience Economy,” Daniel is also a Forbes, Entrepreneur and Huffington Post Contributor. MBA and Graduate Adjunct Professor, Daniel Newman is a Chicago Native and his speaking takes him around the world each year as he shares his vision of the role technology will play in our future.

Todd is an experienced Analyst with over 21 years of experience as a technology journalist in a wide variety of tech focused areas.