The News: Salesforce (NYSE: CRM) reported its Q4 and full year 2022 earnings on March 1, including record revenue for the quarter of $7.33 billion and record revenue for fiscal full year 2022 of $26.49 billion.

This is the first reporting quarter for Salesforce since the company named former COO Bret Taylor to serve as Co-CEO alongside company founder Marc Benioff back on Nov. 30, 2021.

Here is a quick breakdown of the important numbers:

- Fourth quarter fiscal 2022 revenue of $7.3 billion, up 26 percent from $5.8 billion for the same quarter one year ago.

- Fourth quarter non-GAAP net income of $843 million, down 13.5 percent from $975 million one year ago.

- Fourth quarter non-GAAP diluted earnings per share were 84 cents per share, down 19 percent from $1.04 per share one year ago.

- Full year fiscal 2022 revenue of $26.49 billion, up 25 percent from $21.3 billion for full year 2021.

- Full year non-GAAP net income of $4.7 billion, up 1.7 percent from $4.6 billion in fiscal 2021.

- Full year non-GAAP diluted earnings per share of $4.78, down 2.8 percent from $4.92 per share one year ago.

Read the full Salesforce earnings report here.

Salesforce Reports Record Q4 and FY2022 Revenue as Strong Gains Seen in Subscription, Support and Professional Services Sales

Analyst Take: Another quarter, another fiscal year, and yet another strong or record quarter for the Salesforce CRM juggernaut. That is how things have been going for this company for a long time, and we believe there is nothing to slow that trajectory changing anytime soon.

The latest Salesforce Q4 per share earnings impressively outperformed analyst estimates – 84 cents per share reported compared to 74 cents expected, according to Refinitiv. Salesforce Q4 revenue also exceeded Refinitiv estimates, coming in at $7.33 billion compared to a Refinitiv estimate of $7.24 billion.

These are satisfactory results and indicative of a continuing positive direction and strategy by Salesforce and its experienced and forward-looking executive team.

In his commentary, Co-CEO Marc Benioff called out that next year Salesforce would be leaving the “20” billions for good and head into the “30” billions. This, of course, coincides with the aggressive growth plans that Benioff has laid out over the past few years. We had pegged this continued growth as more than achievable based upon the steady growth rate of the core businesses along with the bold acquisitions that included Tableau and Slack.

Business Segment Performance Update

Salesforce saw strong earnings performance in both its subscription and support revenue and in its professional services and other revenue units for the quarter and the year.

- Subscription and support revenue for the fourth quarter was $6.8 billion, up 25 percent from $5.5 billion one year ago. For fiscal FY2022, revenue was $24.7 billion, up 23 percent from $19.9 billion.

- Professional services and other revenue for the fourth quarter totaled $498 million, up 26 percent from $341 million one year ago. For fiscal FY2022 was $1.8 billion, up 44 percent from $1.28 billion one year ago.

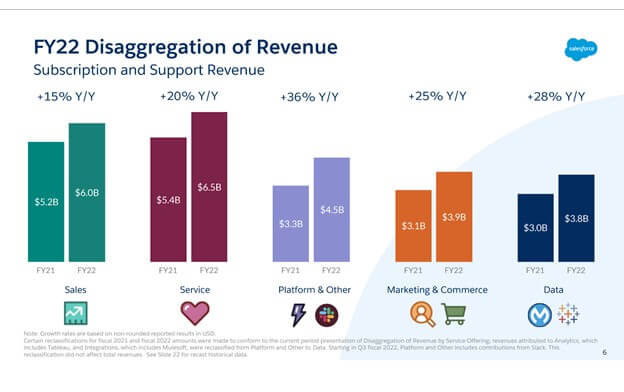

Again, these are impressive results, and Salesforce continues to find new ways to bring new services and new value to its existing and new customers as it grows its user base and earnings. As we have seen over the past few years, the growth of the core businesses including Sales and Services remained in the lower double digits while the Platform, Analytics, and Marketing clouds all grew at a faster clip.

Over the past few years we have maintained a bullish outlook on the continued revenue diversification by Salesforce moving beyond its core businesses and the significant investment in its platform.

Based upon the rapid growth and adoption of Salesforce Platform and the opportunity the company has to compete with Microsoft Team’s for the next workspace, we also see the company’s $27 billion bet on Slack paying off once it fully realizes its vision of the Digital HQ.

Also noteworthy was the strong growth in Europe which came in well over 30%. It’s always encouraging to see strong market diversification showing adoption strength in secondary markets outside of the U.S.

Salesforce Q1 and FY2023 Outlook

We believe that the future looks promising for Salesforce as it continues to serve and grow its customer base in a world that is still working to return to some semblance of normal after two years of the devastating COVID-19 pandemic. The pandemic-inspired move to work from home certainly helped Salesforce increase its sales and services as customers quickly embraced and incorporated deeper digital transformations due to the crisis—something the company was incredibly well designed to support.

Onlookers will need to continue to watch the company’s growth in its emerging technology areas like Platform and Analytics to get a better sense of its long-term prospects. While stable growth in the core businesses should be acceptable, that is only the case if its diversified revenue segments continue to accelerate.

A nice hybrid of growth and value is really what Salesforce has become. Still an innovator that is breaking revenue records, but also a robust recurring revenue machine making big bets in its products, services, and acquisitions. In the end, it would be hard to think these bets won’t payoff. Now we just need to see what the company comes up with when it takes its alleged NFT cloud public.

Disclosure: Futurum Research is a research and advisory firm that engages or has engaged in research, analysis, and advisory services with many technology companies, including those mentioned in this article. The author does not hold any equity positions with any company mentioned in this article.

Other insights from Futurum Research:

Salesforce Safety Cloud Launches, Designed to Streamline COVID Testing and Status Reporting

Making Markets EP19: Quick Take on Salesforce

Image Credit: Rich Picks Daily

The original version of this article was first published on Futurum Research.

Daniel Newman is the Principal Analyst of Futurum Research and the CEO of Broadsuite Media Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise. From Big Data to IoT to Cloud Computing, Newman makes the connections between business, people and tech that are required for companies to benefit most from their technology projects, which leads to his ideas regularly being cited in CIO.Com, CIO Review and hundreds of other sites across the world. A 5x Best Selling Author including his most recent “Building Dragons: Digital Transformation in the Experience Economy,” Daniel is also a Forbes, Entrepreneur and Huffington Post Contributor. MBA and Graduate Adjunct Professor, Daniel Newman is a Chicago Native and his speaking takes him around the world each year as he shares his vision of the role technology will play in our future.

Todd is an experienced Analyst with over 21 years of experience as a technology journalist in a wide variety of tech focused areas.