The News: Hewlett Packard Enterprise (HPE) recently released its Second Quarter Fiscal Year 2022 (Q2 2022) earnings for the period ending on April 30, 2022. Revenue for the quarter was $6.71 billion, up 0.2 percent (up 1.5-percent in constant currency) from the prior year period of $6.70 billion.

Here’s a quick breakdown of the HPE’s Q2 2022 Key Figures:

- Net revenues: Came in at $6.7 billion, up 1.5 percent (in constant currency) over the prior-year period.

- Gross Margins: Non-GAAP gross margins were 34.2-percent, down 0.1 points from the prior-year period.

- Operating Profit: Non-GAAP operating profit of $627 million, down 8 percent from the prior-year period.

- Diluted Net EPS: Non-GAAP diluted net earnings per share was $0.44 versus $0.46 in the prior-year period and was in line with its range of $0.41 and $0.49 per share.

Read the full earnings release on the HPE website.

HPE’s Fiscal Q2 2022 Earnings Remained Positive Despite Supply Chain and Mounting Pressures from the Russia and Ukraine Conflict

Analyst Take: Despite facing headwinds encountered from supply chain issues related to China, coupled with mounting pressures from the Russia and Ukraine conflict, HPE’s fiscal second-quarter revenues remained in positive territory despite disappointing results against the street. I look at the situation at HPE as twofold. HPE is in a continued transition to as a service and that part of the business is performing incredibly well, posting triple digit growth this quarter. However, some of the company’s legacy prem-based hardware and solutions have seen slower growth as revenue pivots to its subscription-based GreenLake portfolio.

Hewlett-Packard Enterprise continues to benefit from myriad areas. It appears HPE’s GreenLake strategy is resonating with organizations and channel partners that want to shift to as-a-service models (e.g., network-as-a-service, etc.), which are likewise resonating with a variety of enterprise customers and certain SMBs driven by pivot to hybrid cloud and consumption-based services.

HPE also announced that it expanded its partner ecosystem, increasing its number of partners that are actively selling the product this quarter by more than fifty percent versus the same period last year. With the GreenLake product portfolio expanding and competition also growing in the hybrid cloud space, HPE’s leaning on its channels makes a lot of sense to scale adoption. And of course, incenting the channels will be important as others look to partners for growth.

Another area bearing fruit for HPE is in the high-performance compute segment, where its prior investments in Cray and Silicon Labs continue to help it differentiate itself, creating more stickiness with key vertical markets such as higher-education, federal, financial services, etc., that need to harness the power of artificial intelligence to solve more complex problems. In the future, it may make sense that HPE could become more acquisitive on the analytics front, catering to key market vertical markets in the future.

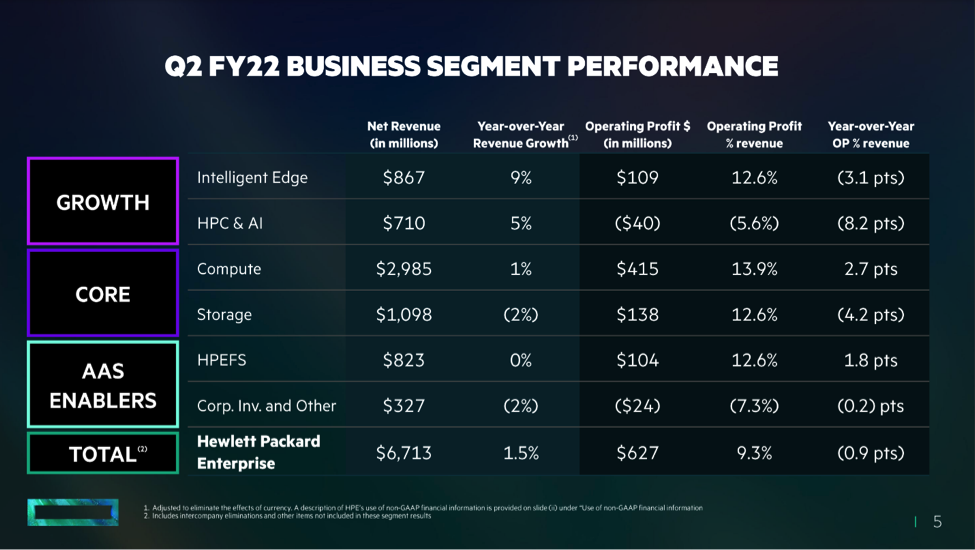

HPE Results by Segments:

- Intelligence Edge: Revenues were $867 million, up 8 percent from the prior year period and 9 percent when adjusted for currency. Unit operating margins were 12.6 percent versus 15.7 percent in the prior-year period. The segment continues to perform well and should be pick up a little tailwind in the Americas as the education buying cycle peaks in June.

- High Performance Computing & AI: Revenues were $710 million, up 4 percent from the prior-year period in actual dollars and 5 percent when adjusted for currency. Despite the lumpiness of the business unit, we believe it will continue to be buoyed as more organizations adopt big data strategies and want to harness the power of artificial intelligence to solve big problems in the future.

- Compute: Revenues were $3.0 billion, flat from the prior year period in actual dollars and up 1 percent when adjusted for currency. Operating margins were 13.9 percent compared to 11.2 percent from the prior-year period. Segment margin expansion was due to strategic pricing actions which offset input cost increases.

- Storage: Revenues was $1.1 billion, down 3 percent from the prior-year period in actual dollars and 2-percent when adjusted for currency.

- Financial Services: Revenues were $823 million, down from the prior-year period in actual dollars and flat when adjusted for currency. Operating margins were 12.6 percent versus 10.8 percent from the prior-year period.

HPE Q3 2022 Outlook

According to the management team, HPE’s fiscal third-quarter GAAP diluted net earnings per share should be in the range of $0.22 to $0.32 with non-GAAP diluted earnings per share to be $0.44 to $0.54.

Wrapping it up, HPE’s fiscal Q2 2022 earnings continued to remain in positive territory despite regional and inflationary pressures coupled with supply chain issues. HPE remains focused on its as-a-service strategy coupled with differentiating itself in myriad areas.

As we have mentioned over the past several quarters, HPE is in transition and the focus area is delivering results that are visible in the as-a-service growth and the margin expansion that HPE has been able to achieve. We do see the process of transformation as a continued effort and not an overnight phenomenon. Having said that, HPE and GreenLake have performed quite well, gaining plaudits for their early commitment and innovation to meeting IT where it is heading. That doesn’t remove the reasonable challenges and headwinds ahead of the company, but it does make for an encouraging direction that investors, employees, and customers can glom onto.

Disclosure: Futurum Research is a research and advisory firm that engages or has engaged in research, analysis, and advisory services with many technology companies, including those mentioned in this article. The author does not hold any equity positions with any company mentioned in this article.

Analysis and opinions expressed herein are specific to the analyst individually and data and other information that might have been provided for validation, not those of Futurum Research as a whole.

Other insights from Futurum Research:

HPE Dazzles with Host of New HPE GreenLake Capabilities and Partnerships

MWC 2022: Qualcomm and HPE Prep Virtual Distributed Units for 5G Prime Time

Image Credit: HPE

The original version of this article was first published on Futurum Research.

Daniel Newman is the Principal Analyst of Futurum Research and the CEO of Broadsuite Media Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise. From Big Data to IoT to Cloud Computing, Newman makes the connections between business, people and tech that are required for companies to benefit most from their technology projects, which leads to his ideas regularly being cited in CIO.Com, CIO Review and hundreds of other sites across the world. A 5x Best Selling Author including his most recent “Building Dragons: Digital Transformation in the Experience Economy,” Daniel is also a Forbes, Entrepreneur and Huffington Post Contributor. MBA and Graduate Adjunct Professor, Daniel Newman is a Chicago Native and his speaking takes him around the world each year as he shares his vision of the role technology will play in our future.

Michael Diamond is an industry analyst and foresight professional with 25 years of experience in the IT channel and market research industry. He is a route-to-market expert covering desktop and mobile devices, collaboration, contact center, ProAV, data center infrastructure, and cybersecurity. Prior to joining Futurum Research, Michael worked for The NPD Group as the sole industry analyst covering indirect channels, cybersecurity, SMB and vertical market trends, data center infrastructure (e.g., enterprise storage, servers, networking), ProAV and PCs. He has been quoted by media outlets such as Bloomberg, Kiplinger, TWICE, OPI (Office Products International), Apple World today, Dark Reading, Enterprise Storage Forum, Credit-Suisse, Footwear News, CRN (Computer Reseller News), Channel Futures and Into Tomorrow. Michael has presented at myriad events including The Channel Company’s Xchange, The Global Technology Distribution Council’s summit, SMB TechFest and more.