The News: Oracle shares fell as much as 2% in extended trading Thursday after the company reported fiscal second-quarter earnings that beat analysts’ expectations. The shares recovered after the company issued better-than-expected quarterly guidance.

Here’s how the company did:

- Earnings: $1.06 per share, adjusted, vs. $1.00 per share as expected by analysts, according to Refinitiv.

- Revenue: $9.80 billion, vs. $9.79 billion as expected by analysts, according to Refinitiv.

Oracle’s revenue grew nearly 2% year over year in the quarter, which ended Nov. 30, according to a statement. In the prior quarter revenue increased by almost 2%. Read the full news item on CNBC.

Analyst Take: Last quarter, Oracle returned to growth amidst a tumultuous 2020 year that has challenged a number of traditional IT business models. In its second-quarter for its fiscal 2021 year, Oracle continued its YoY growth, albeit with a small gain of 2% that was the result of an offset of hyper-growth in some of its cloud/SaaS segments, while seeing a bit of a slow down in some of its on-prem and traditional business segments.

Breaking Down the Businesses

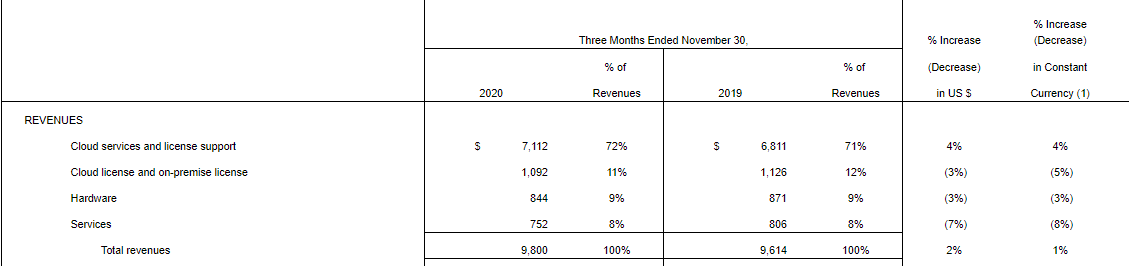

Oracle’s business breaks down into four categories. The biggest bucket, Cloud services and license support, representing 72% of the company’s revenue, saw growth this quarter. In contrast, the other three groups, Cloud license and on-premise license, hardware, and services, all saw declines.

Despite the pullback from some of the smaller segments, Cloud services and license support was able to carry Oracle to growth. For the quarter, the group delivered $7.11 billion in revenue, growing 4% on an annualized basis coming in slightly above the $7.04 billion consensus among analysts polled by FactSet.

Revenue from its cloud and on-premises licenses came in at $1.09 billion for the quarter, which was solid sequential growth over the $886 million last quarter; however, short of the $1.13 billion from the same time last year. This is one of the categories that has seen some slow down due to the Covid-19 impacts on infrastructure and IT projects during 2020.

Oracle SaaS Continues to Deliver Strong Growth

A real bright spot for Oracle came in its cloud applications businesses, which continued their rapid revenue growth with Fusion ERP up 33% and NetSuite ERP up 21%, a continuation of 33% and 23% from the previous quarter showing not just momentary, but continued growth for these cloud-based services. This growth adds to the more than 7,300 Fusion ERP customers and 23,000 NetSuite ERP customers in the Oracle Cloud (Q1 Earnings Metrics).

The company was also able to provide significant indications of growth in its infrastructure business. In the company’s earnings release, Larry Ellison noted that the demand for its Gen2 Cloud Infrastructure is up in excess of 100% (138% actual) YoY and that it is pushing the company to open up new regions and data centers at scale. In 2020, the company opened 13 new regional datacenters taking the total to 29 regional datacenters around the world.

I also believe the company’s announcements around its new X8M Exadata Cloud Service will provide a catalyst for growth in future quarters.

Significant Customer Wins in Q1 for Oracle:

During its fiscal Q2, the company shared several significant wins that included recognized names, including Equinix, Howard Huges Medical Institute (HHMI), First Solar, and T-Mobile.

These wins included upgrades and migrations of software to Oracle Cloud Infrastructure. Equinix committed its future to Oracle’s Fusion Cloud suite (ERP, EPM, CX), replacing older Oracle e-business suite applications. HHMI decided to use Oracle’s Cloud Infrastructure to move various high-performance computing workloads to the cloud. T-Mobile decided to leverage Oracle Retail cloud applications to plan, distribute, and optimize retail experience and deliver scale to T-Mobile’s business as 5G drives increasing demand.

I appreciate that Oracle continues to share a diverse set of wins across its portfolio, giving a better sense of how customers are engaging Oracle and what problems are being solved across its diverse solutions.

Oracle and TikTok?

Not much is being said about this as other topics have been prioritized, but there is still speculation that Oracle could become 12.5% of TikTok global, but that deal hasn’t closed at this point. I’m beginning to think as we move administrations that this may not come to fruition. However, it’s worth keeping an eye on.

Overall Impressions of Oracle’s Earnings (Q2 FY 2021)

Oracle’s growth this quarter, albeit small, continues promising momentum from the company, with the growth coming from the right places–SaaS and Cloud. The challenges in more legacy portions of the company’s business isn’t surprising as diverse companies with significant on-prem IT business segments like Oracle, IBM, Dell, Cisco, and HPE, have all slowly returned to YoY growth but hardly saw the revenue boon of some of the pure cloud players.

For its fiscal Q3, Oracle anticipates 2-4% growth while analysts are targeting 1.5% YoY at $9.95 billion. Oracle is targeting an EPS of $1.09 to $1.13. A continuation of small YoY growth that shows positive momentum but probably doesn’t satisfy those seeking much faster growth from the tech sector. I expect the cloud and SaaS growth areas like Fusion and Netsuite, and Gen2 Cloud to carry the growth number for Q3 once again.

This quarter’s results give a foundation of results from Oracle to be encouraged about. A second-quarter of YoY growth in a year that has challenged many, but not all, IT giants.

Futurum Research provides industry research and analysis. These columns are for educational purposes only and should not be considered in any way investment advice.

Read more analysis from Futurum Research:

Amazon Deepens Climate Pledge Adding Microsoft and 12 Others

AWS reInvent 2020: 5 Big Announcements From Andy Jassy’s Keynote

C3.ai IPO Reflects Momentum Around Vertical AI Solutions

The original version of this article was first published on Futurum Research.

Daniel Newman is the Principal Analyst of Futurum Research and the CEO of Broadsuite Media Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise. From Big Data to IoT to Cloud Computing, Newman makes the connections between business, people and tech that are required for companies to benefit most from their technology projects, which leads to his ideas regularly being cited in CIO.Com, CIO Review and hundreds of other sites across the world. A 5x Best Selling Author including his most recent “Building Dragons: Digital Transformation in the Experience Economy,” Daniel is also a Forbes, Entrepreneur and Huffington Post Contributor. MBA and Graduate Adjunct Professor, Daniel Newman is a Chicago Native and his speaking takes him around the world each year as he shares his vision of the role technology will play in our future.