The News: Microsoft shares moved 3% lower on Tuesday after the company reported fiscal third-quarter earnings that came in stronger than analysts had expected.

Here’s how the company did:

- Earnings: $1.95 per share, adjusted, vs. $1.78 per share as expected by analysts, according to Refinitiv.

- Revenue: $41.71 billion, vs. $41.03 billion as expected by analysts, according to Refinitiv.

The software and hardware maker posted 19% annualized revenue growth for the quarter, which ended March 31, according to a statement. That’s the biggest quarterly increase the company has posted since 2018, thanks in part to gains in PC sales resulting from coronavirus-driven shortages last year. Read the full news item from CNBC.

Analyst Take: Microsoft delivered a robust result in its fiscal Q3, reporting revenue of $41.71B and EPS of $1.95, topping consensus estimates of $41.03B and $1.78 EPS respectively.

The company realized impressive double-digit growth in Revenue, Operating Income, Net Income, and EPS across the board, which should add to investors’ confidence as we move into the later phases of the pandemic and begin to see a return to more normal business activity and behavior in the 2nd half of the calendar year.

- Revenue was $41.7 billion and increased 19%

- Operating income was $17.0 billion and increased 31%

- Net income was $15.5 billion GAAP and $14.8 billion non-GAAP, and increased 44% and 38%, respectively

- Diluted earnings per share was $2.03 GAAP and $1.95 non-GAAP, and increased 45% and 39%,respectively

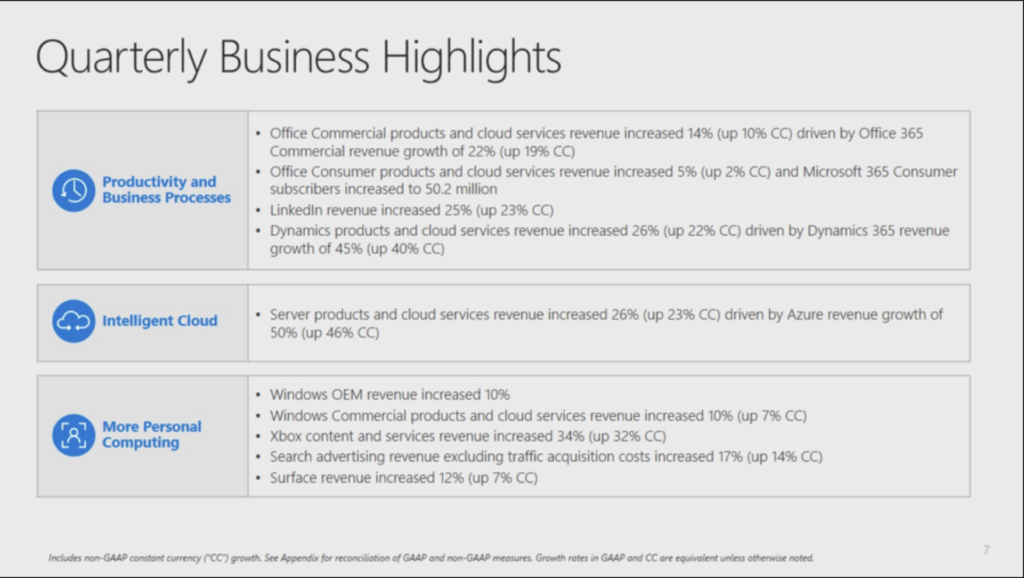

For this earnings period, I was once again closely watching the company’s performance in three major areas. Productivity, Intelligent Cloud, and Personal Devices/Computing. This encompasses the vast majority of the company’s revenue and it had strong results in all three, with Intelligent Cloud, Dynamics 365, and Azure leading the way:

Intelligent cloud and Azure saw strong growth at 23% and 50%, respectively, showing continued strong cloud demand and an solid sustained result versus last quarter where growth came in at 26% and 50% respectively. There have been some question marks over the past several quarters as to whether Microsoft could maintain this level of cloud demand as the pandemic continues, and now moreover as we exit the pandemic, but as I see it there is a strong correlation between the economic rebound numbers and investments in cloud technology. Furthermore, there are industries that have been in contraction that are starting to bounce back that will be turning to tech investment to future proof their business–Microsoft stands to benefit from these rebounding industries.

With all of this in mind, it’s hard not to be bullish about the Azure offerings. Microsoft and AWS continue to expand their offerings and this expansion is leading to greater revenue and stickiness among its customers. I said last quarter that I wouldn’t be surprised to see this 45-50% growth for Azure sustain for another 3-4 quarters based upon current momentum. 1/1 so far, with this quarter coming in at the top of the range.

Productivity and Business Applications Grow

Microsoft’s Productivity segment continued its strong performance which continued a string of double-digit growth (15%), beating last quarter’s 13% growth as demand in the market for Office 365 continues to rise. The area that has continued to capture my attention has been the growth of Microsoft’s own play in CRM/ERP — Dynamics, and Dynamics 365 business. I feel this area of growth is benefitting materially from the continued strength in the company’s Azure business as well as its Power Platform gaining momentum. This bodes well for the Dynamics and Cloud ERP (Dynamics 365) category, which the latter continues to be big for this category delivering 45% growth this quarter. I’ve been speculating for some time about a tighter race in business productivity and this thesis seem to be gaining momentum–especially with Salesforce and Microsoft continuing to look like the fiercest of competitors.

LinkedIn continues to look like a solid diversification play with revenue up 25%. This has been a bit of an unsung hero in the productivity and business processes category, but I see the long-term role that LinkedIn has to play as a critical differentiator and important for the company’s desire to play and expand in hot social communities, much like it has with GitHub for developers. However, the no-go on the TikTok and Discord deals shows that Microsoft having interest in an acquisition doesn’t always materialize.

The last category I tracked closely for this quarter was the “More personal” segment, which saw 19% category growth led by big growth in Xbox content and services at 34%. Gaming had another very strong result based upon the continued demand for the new Xbox Series X|S, which saw hardware Revenue spike by 86% in the previous quarter. Surface revenue picked back up this quarter after a slower second quarter coming in at 12%. This will be interesting to hear more about in the earnings call and follow up analysis. Microsoft had been showing signs of competing in Apple’s ultra high-end laptop space, but the growth has been slower than overall PC growth, which has been pegged around 30%. It’s worth noting a lot of the growth in PC and Notebook has been downmarket, which isn’t an area where Surface is trying to be present.

Overall Impressions of Microsoft FY 21 Q1 Earnings

Overall, FY ’21 Q3 was an excellent quarter for Microsoft. The growth equaled its best since 2018 and the key is going to be sustaining this strong momentum. As its cloud business continues to grow, large numbers can challenge big growth percentages, but the uptick this quarter shows that there is still growth to be had. Satya Nadella has indicated in many ways that he sees a clear growth opportunity, and that the large quarterly results are not a prohibitor of future growth.

It also remains clear that even the pandemic and its lingering effects have attached to digital investment rather than negatively impacting spending. We are also seeing this spend and strength in technology continue even as more of the economy is opening up, and certain industries that have been devastated by Covid-19 are starting to return to a more normal business rhythm.

Futurum Research provides industry research and analysis. These columns are for educational purposes only and should not be considered in any way investment advice.

Read more analysis from Futurum Research:

Rackspace Elastic Engineering Unleashed, With a Goal of Transforming Cloud Managed Services

Honeywell Comes In Above Expectations as Software Helps Drive Growth

Intel Beats Expectations as PC Demand Surges in Q1

Image: Microsoft

The original version of this article was first published on Futurum Research.

Daniel Newman is the Principal Analyst of Futurum Research and the CEO of Broadsuite Media Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise. From Big Data to IoT to Cloud Computing, Newman makes the connections between business, people and tech that are required for companies to benefit most from their technology projects, which leads to his ideas regularly being cited in CIO.Com, CIO Review and hundreds of other sites across the world. A 5x Best Selling Author including his most recent “Building Dragons: Digital Transformation in the Experience Economy,” Daniel is also a Forbes, Entrepreneur and Huffington Post Contributor. MBA and Graduate Adjunct Professor, Daniel Newman is a Chicago Native and his speaking takes him around the world each year as he shares his vision of the role technology will play in our future.