The News: Intel reported second-quarter (Q2) revenue of $15.3 billion, down 22% year over year (YoY), and non-GAAP revenue of $15.3 billion, down 17% YoY. Intel’s Client Computing and Datacenter and AI Groups were largely impacted by continued adverse market conditions; Network and Edge Group and Mobileye achieved record quarterly revenue. Intel revised full-year guidance to the $65 billion to $68 billion range while also reiterating full-year adjusted free cash and guidance. Intel’s Q2 earnings per share (EPS) was $0.11; non-GAAP EPS was $0.29. Read the Intel Press Release here.

Intel Q2 2022: The Bad, The Good, and the CHIPs Act

Analyst Take: Intel’s earnings for Q2 2022 largely missed consensus outlooks related to its top-line and bottom-line expectations and not surprisingly, Intel CEO Pat Gelsinger succinctly noted that Intel’s Q2 results were below the standards the company set for itself and its shareholders. Keeping the Q2 2022 results in mind, Gelsinger reiterated that Intel remains laser-focused on its strategy and long-term results and will embrace the challenging environment with a continued commitment to accelerate its overall transformation.

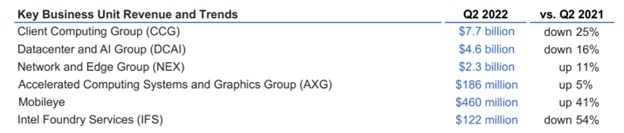

Here is the performance of Intel’s business segments in Q2 2022:

Intel Q2 2022: The Bad – Client Computing Group and Data Center & AI Group

As the breakout of the business segment performance indicates, Intel’s CCG unit faced serious headwinds in Q2 2022 as worldwide adoption of PCs, including Apple Mac products, has slowed down in the post-pandemic era after a two-year boom during the lockdown stretch of the global pandemic. Intel’s CCG unit Q2 revenues were down 25% YoY due primarily to what we believe are buyers taking a break from their pandemic-era spending surge. Also, we see ongoing supply chain issues stemming from the uncertainties of the global pandemic continuing to impact PC and consumer electronic sales. Based upon recent market size data and sentiment from semiconductor peers like Micron and Samsung, there were some clear indicators heading into earnings that Intel would see a sizable pullback in CCG, which it did.

Intel’s DCAI unit attributed its YoY decline of 16% due to considerations such as the weakening U.S. and global economy, supply chain and inventory turbulence, and overall competitive pressures including from key rivals such as AMD, as well as competitors leveraging designs from Arm. From our view, the sizable dip in data center and AI revenues was more surprising than CCG’s shortfall, as the dip in global PC sales was well anticipated. AMD, for example, has consistently gained market share in the data center semiconductor segment over the last three years. While the PC (CCG) contraction shouldn’t have surprised many, the DCAI was a bit softer than expected, as the same cohort that had indicated contraction in the PC space had largely reiterated strength in the data center. Slips in Sapphire Rapids and Gelsinger’s comments about execution likely have a larger part in this result.

Intel Q2 2022: The Good – NEX, AXG, and Mobileye

We expect that most of the industry will focus on the poor results in the CCG and DCAI units that substantially dragged down the company’s overall Q2 earnings. That stands to reason. However, there are areas of progress that warrant attention as we anticipate they can prove integral to any near-term comeback that Intel must execute.

For example, Intel is ramping up Intel 7, which is now shipping in aggregate of over 35 million units. Intel is envisaging Intel 4 to be ready for volume production in the second half of 2022 and is ahead of or on schedule for the Intel 3, 20A and 18A offerings.

In DCAI, Intel is using its integrated device manufacturing (IDM) advantage to fulfill Meta’s expanding compute requirements. Intel is broadening its alliance with AWS to prioritize the co-development of multi-generational DC solutions that are optimized specifically for AWS infrastructure, including Intel itself as a customer for internal workloads, including electronic design automation (EDA). Intel foresees its custom Xeon solutions delivering TCO and differentiation advantages to AWS and its customer footprint (Intel included). Also, NVIDIA selected Sapphire Rapids CPUs for use in its new DGX-H100, which combines NVIDIA’s Hopper GPUs with Sapphire Rapids with the goal of advancing AI performance in DC environments.

Intel’s NEX unit attained record revenues, as Q2 revenues were up 11% YoY. NEX began shipping Mount Evans, a 200G ASIC IPU co-developed and beginning to ramp with a major hyperscaler. In addition, the Xeon D processor is gaining industry-wide traction.

Intel’s AXG unit revenues were up 5% YoY as it shipped the first Intel Blockscale ASIC, and the Intel Arc A-series GPUs for laptops began shipping with original equipment manufacturers (OEMs) including Samsung, Lenovo, Acer, HP, and Asus.

Mobileye also achieved record revenue in the quarter, with first half design wins generating 37 million units of projected future business across the autonomous driving segment. We foresee Intel sticking to the proposed spinoff Mobileye in alignment with Mobileye’s IPO draft filing of March 2022. While we see the IPO market softening in H2 2022, we expect Intel needs to prioritize the Mobileye spinoff to help streamline its own operations as well as improve its overall financial picture. However, the overall market conditions could prolong the transition further into 2022 or even 2023 as the IPO market is far from prime at this juncture.

Taken together, we do not believe these positive developments outweigh the challenges the CCG and DCAI units experienced in Q2 2022, but point to how Intel can turn its ship around more swiftly with the provision that it executes according to Gelsinger’s vision and strategic plan.

Intel Q2 2022: IFS and the CHIPs Act

IFS Q2 revenues were down 54% YoY. Bearing that in mind, IFS recently unveiled its partnership with MediaTek built chips for a range of smart edge devices using Intel process technologies. Moreover, Intel launched the IFS Cloud Alliance, the next phase of the company’s accelerator ecosystem program that targets boosting secure design environments across cloud environments.

We view the Intel MediaTek alliance as a winner, as it enables two major semiconductor players to bolster semiconductor production using production from IFS in current fab plants and fab facilities that are planned for expansion or new construction. As such, we expect the partnership can accelerate the availability of new chips to smart edge device manufacturers as soon as they can have the production lines tooled up and running.

From our view, IFS customers, including MediaTek, are becoming better positioned to reap the benefits of Intel’s ongoing factory expansion objectives at existing chip fab sites, as well as plans for major new investments at new facilities in Ohio and Germany.

All of this comes as the U.S. Senate just announced passage of the $52 billion CHIPs act and sends it along to the House, where it is expected to pass — a sizable win for Intel’s long-term prospects. The bill will provide funding to catalyze the construction of chip fab facilities to help supply a world that continues to be strained by supply chain issues, including industry-wide post-pandemic adjustments, Covid-19 related shutdowns in China, and the Russian aggression in Ukraine.

The bulk of the CHIPS Act is a $39 billion fund that will subsidize companies, such as Intel, Micron, and Texas Instruments, to expand or build new semiconductor manufacturing facilities in the U.S. This clearly aligns with Pat Gelsinger’s declaration that Intel will remain laser-focused on its strategy and long-term results, as well as Intel’s assertion that its IDM/IDM 2.0 assets can provide a competitive advantage, particularly longer term, over non-fab rivals like ADM and NVIDIA. However, building and upgrading semiconductor manufacturing plants is a multi-year process and Intel must execute on its IDM 2.0 plans while not taking its eye off reversing the fortunes of its CCG and DCAI units.

Intel Q2 2022: Key Takeaways

Overall, we see Intel needing to assess its forward-looking prospects with more scrutiny as it significantly resets expectations through the revision of full-year guidance at the $65 billion to $68 billion range, down from Q1 2022 full year outlook of $76 billion, while also reiterating full-year adjusted free cash and guidance.

This includes fuller accounting of rising costs for the production and expensive materials used in the production of the company’s semiconductors. For instance, macroeconomic concerns related to inflation rising, with the U.S. Consumer Price Index increasing 9.1 percent over the 12 months ended June 2022, are also contributing to upward pricing pressures across the entire semiconductor supply chain.

Analysis and opinions expressed herein are specific to the analyst individually and data and other information that might have been provided for validation, not those of Futurum Research as a whole.

Other insights from Futurum Research:

Intel MediaTek Chip Partnership Will Drive Global Production

Intel Vision 2022: Intel Augments its Silicon, Software, and Services Portfolio Vision

Intel Q1 2022 Earnings Beats on Top and Bottom Line, But Guidance Continues to Be a Sticking Point

Image Credit: MarketWatch

The original version of this article was first published on Futurum Research.

Daniel Newman is the Principal Analyst of Futurum Research and the CEO of Broadsuite Media Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise. From Big Data to IoT to Cloud Computing, Newman makes the connections between business, people and tech that are required for companies to benefit most from their technology projects, which leads to his ideas regularly being cited in CIO.Com, CIO Review and hundreds of other sites across the world. A 5x Best Selling Author including his most recent “Building Dragons: Digital Transformation in the Experience Economy,” Daniel is also a Forbes, Entrepreneur and Huffington Post Contributor. MBA and Graduate Adjunct Professor, Daniel Newman is a Chicago Native and his speaking takes him around the world each year as he shares his vision of the role technology will play in our future.