The News: Twilio TWLO, -0.46% reported a net loss of $227.9 million, or $1.31 a share, vs. net income of $99.9 million, or 71 cents a share, in the year-ago quarter. The company reported adjusted net loss of 11 cents a share.

Revenue bolted 67% to $668.9 million from $400.8 million a year ago.

Analysts surveyed by FactSet had expected a net loss of 13 cents a share on revenue of $599 million.

Twilio’s shares are up 15.5% so far in 2021. The broader S&P 500 index SPX, +0.42% has gained 18% this year. Read the news piece on MarketWatch.

Analyst Take: Twilio continued its string of strong top line growth results as demand for its products continues to surge. As we enter what hopefully is the late innings of the Covid-19 pandemic, brands, throughout the pandemic made significant investments to be able to optimize customer experience by delivering the right offer, at the right time, to the right customer. The pivot to expanded digital demand and expectation served as a tailwind for Twilio. While the market’s reaction following earnings led to a slight sell-off, this wasn’t due to lacking performance during the company’s first quarter.

The company was able to significantly outperform the market delivering $669 million in revenue, representing 67% YoY growth for the quarter while also beating expected EPS by coming in at -$.11 versus an expected loss of -$.13.

For the 2nd quarter, there was clear growing interest in improved customer engagement and maximizing broad adoption of Twilio Solutions. In the company’s State of Customer Engagement Report, published in February, 95% of respondents reported plans to increase or maintain their current communication channel offerings with companies looking to add an average of four new channels (think live chat, IVR, video, etc.). The revenue climb aligns with the expected growth and maintenance of customer engagement investments.

Twilio Delivers Best Growth Since Q3 2019

As Twilio’s quarterly revenue continues to rapidly approach a billion dollars, it would be easy to see growth percentage slow down, however, the past 3 quarters all being over 60% makes a strong case for momentum, and stronger adoption as the Twilio ecosystem of developers and solutions continues to expand.

From a technology standpoint, Twilio is rapidly expanding from a platform to reach your customer via a simple text or voice message to a much more engaging platform that can do everything from outbound voice, video, text to full 360 degree customer optimization using the capabilities of Segment’s CDP, which Twilio acquired in 2020 for ~$3.2 billion. This quarter Segment growth surpassed 50%, providing an indicator that the diversification play is taking shape.

Acquisitions have also been very strategic to successfully expand the company’s core business. ZipWhip, for instance, was an $850 million investment made this year to streamline the business texting capabilities. I like seeing the core and breadth being looked at during this stage of company growth.

This was further emphasized last quarter when the company shared its plans for restructuring of its R&D efforts to focus on its communications, platform, and core solutions.

Twilio is built using a platform approach that enables its more than 10 million developers to build upon its API. The platform continues to be enhanced with more tools to allow developers to create more meaningful two-way engagement with customers with tools like Twilio Conversations and use AI to augment human contact center interactions.

The company’s objective is to be a vehicle for reaching the right customer at the right time. It’s API’s empower companies to market more effectively, and its growth reflects a strong market acceptance. Furthermore, its strong developer ecosystem is a catalyst for growth and seems to be continuously growing, which means more development with and around the Twilio solution set.

Twilio Delivers Insights into its Business With Customer Wins and More Key Updates

During the quarter, Twilio continued to win substantial deals. Here are a few of the highlights extracted from Twilio’s results this quarter.

- More than 240,000 Active Customer Accounts as of June 30, 2021, compared to 200,000 Active Customer Accounts as of June 30, 2020. Active Customer Accounts as of June 30, 2021 include Twilio Segment customer accounts.

- Dollar-Based Net Expansion Rate was 135% for the second quarter of 2021, compared to 132% for the second quarter of 2020. Twilio Segment results do not impact the calculation of this metric in either period.

- 6,334 employees as of June 30, 2021.

- Closed the acquisition of Zipwhip, a trusted partner to carriers and a leading provider of toll-free messaging in the United States.

- Announced Twilio Segment Journeys, allowing marketers to build customer journeys on top of the world’s #1 Customer Data Platform.

- Released Twilio’s 2020 Diversity, Equity and Inclusion report, highlighting Twilio’s efforts around anti-racism and representation.

Twilio Q2 Guidance Encouraging

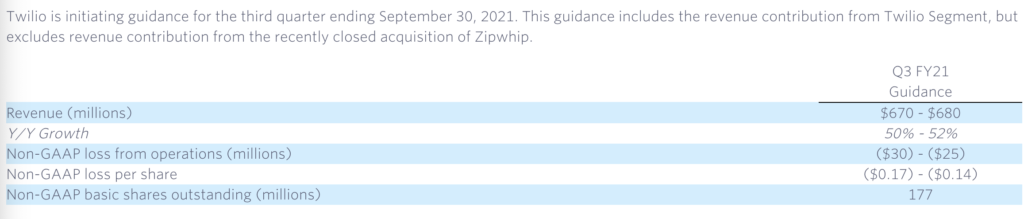

Twilio only guides out one quarter, but the next quarter looks like growth acceleration is expected to continue with 50-52% growth over the previous year ($670-680 million). Operating Loss on this revenue will be around $25-30 million as the company continues to pursue strong top-line growth. In the past two of the past three quarters, we saw that the company delivered a positive EPS result despite negative guidance. I maintain my perspective that the company’s unexpected EPS outperforms during a number of the past few quarters may be a sign of it approaching sustainable profitability with its next wave of revenue growth. However, it is clear that top line growth, product expansion, and developer growth are currently higher priorities than EPS as significant growth is company’s long-term answer to stronger profits.

Overall Impressions of Twilio Q2 Results

Twilio finds itself in the right spot in the market at the right time for growth. While not the only company tackling the customer engagement challenge, it certainly comes from the right place in terms of high-touch, real-time, attended human channels–essentially our mobile devices.

The company saw stable growth over the past year, now able to tout more than 240,000 Active Customer Accounts as of June 30, 2021, compared to 235,000 Active Customer Accounts as the close of the previous quarter.

With the goal of improving every customer-brand interaction, I believe Twilio finds itself on a strong trajectory. The strong net revenue expansion numbers, the persistent moves upmarket, and the implementation of dynamic leading-edge technologies like AI and hyper-automation reflect its ambition to reach customers and enable the enterprise to differentiate customer experiences. All of which to say, the long-term road looks promising for Twilio.

Futurum Research provides industry research and analysis. These columns are for educational purposes only and should not be considered in any way investment advice. Neither the Author or Futurum Research holds any positions in any companies mentioned in this article.

Other insights from Futurum Research:

Honeywell Q2 Highlighted by Strong Execution and EPS Expansion

Qualcomm Blows Past Estimates on 5G and Growth Plays

Microsoft Sees Overall Revenue Growth Pass 20% in Q4

Image Credit: Twilio

The original version of this article was first published on Futurum Research.

Daniel Newman is the Principal Analyst of Futurum Research and the CEO of Broadsuite Media Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise. From Big Data to IoT to Cloud Computing, Newman makes the connections between business, people and tech that are required for companies to benefit most from their technology projects, which leads to his ideas regularly being cited in CIO.Com, CIO Review and hundreds of other sites across the world. A 5x Best Selling Author including his most recent “Building Dragons: Digital Transformation in the Experience Economy,” Daniel is also a Forbes, Entrepreneur and Huffington Post Contributor. MBA and Graduate Adjunct Professor, Daniel Newman is a Chicago Native and his speaking takes him around the world each year as he shares his vision of the role technology will play in our future.