The News: Salesforce shares fell as much as 4% in extended trading on Thursday after the enterprise-software company issued earnings that exceeded analysts’ estimates, but Salesforce came up short on its full-year earnings forecast as it factors in the implications of buying team communication app Slack.

Here’s how the company did:

- Earnings: $1.04 per share, adjusted, vs. 75 cents per share as expected by analysts, according to Refinitiv.

- Revenue: $5.82 billion, vs. $5.68 billion as expected by analysts, according to Refinitiv.

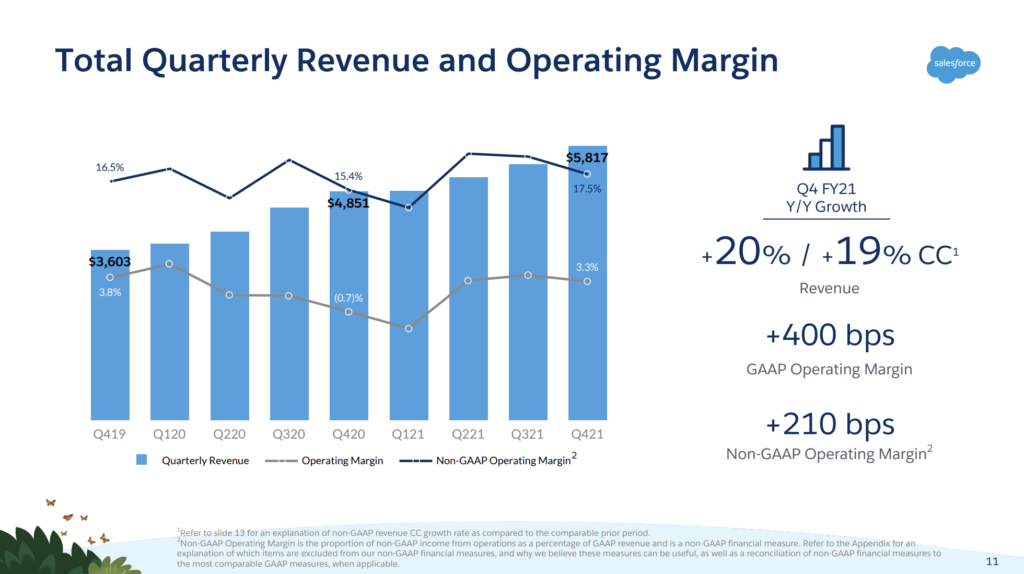

Salesforce reported 20% year-over-year revenue growth in the fourth quarter of the company’s 2021 fiscal year, which ended on Jan. 31, according to a statement. In the previous quarter revenue grew 20%. Read the full news item on CNBC.

Analyst Take: The results in the final quarter of its FY ’21 represents a continuation of sound results from Salesforce, which I often refer to as the bell weather for SaaS.

While the overall results delivering 20% revenue growth for the quarter and 24% revenue growth for the year, along with the outperform for EPS should have driven a spike in the share price. Recent trends have shown greater propensity toward buying up to earnings and selling on good results. This has been a pronounced feature in big tech lately as buy the rumor, sell the news has become more pervasive.

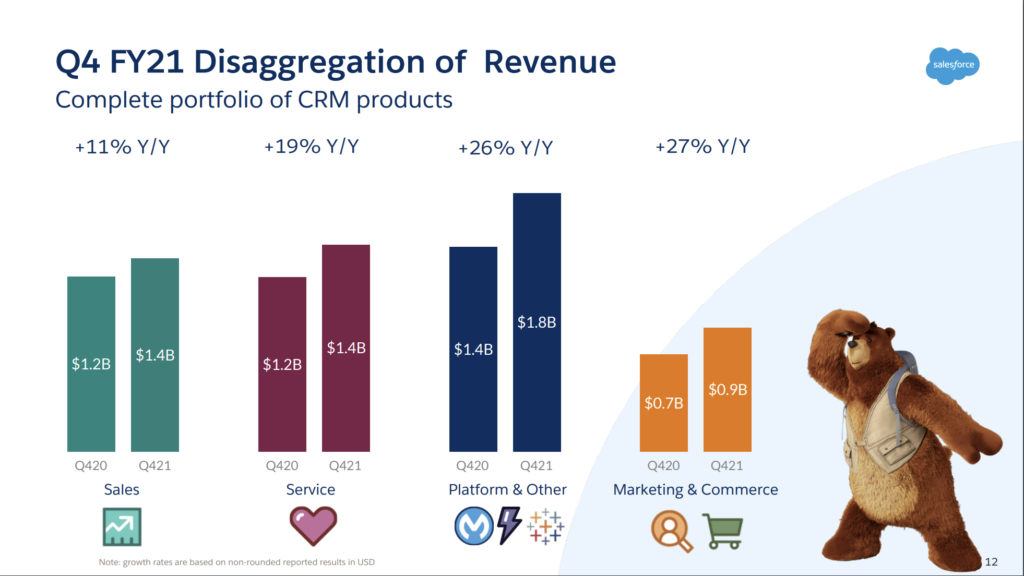

Revenue Buckets Show Platform Momentum and Stable Growth Throughout

While the Sales Cloud still represents the best known component of the Salesforce portfolio, the most pronounced growth in the quarter came from the Platform and the Marketing Cloud. The platform, which has seen significant growth since the acquisitions of Mulesoft and Tableau, has usurped the sales and service clouds to become consistently Salesforce’s largest revenue generator and among its fastest growing segments.

I’m encouraged by what Salesforce is doing here, as platforms continue to be a core value proposition for enterprise extensibility. Early on I noted my concern about the shift away from pure SaaS to address hybrid cloud capabilities. The company through its acquisitions and platform development has addressed many of those concerns. Also, building key capabilities like Hyperforce to scale as hybrid cloud continues to dominate enterprise architecture.

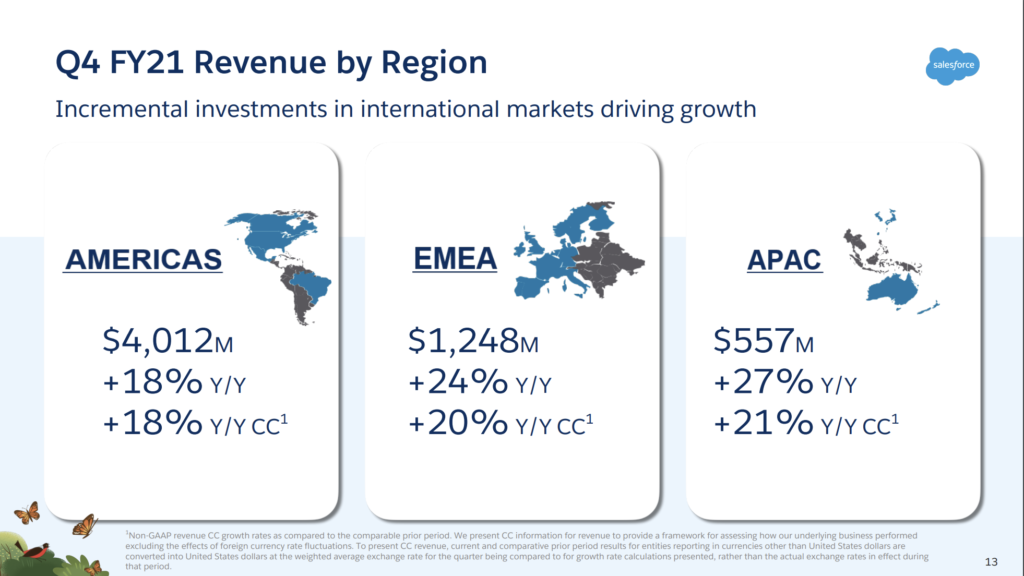

Seeing a Broadening Global Uptake

One interesting observation during this earnings period was the stronger growth outside of Americas. This shows me that the company is focusing on the larger global revenue opportunity, but also that global uptake has been steady.

With Salesforce growth in APAC and EMEA outpacing Americas, I view this as a key to sustained 20%+ growth in its FY22 results.

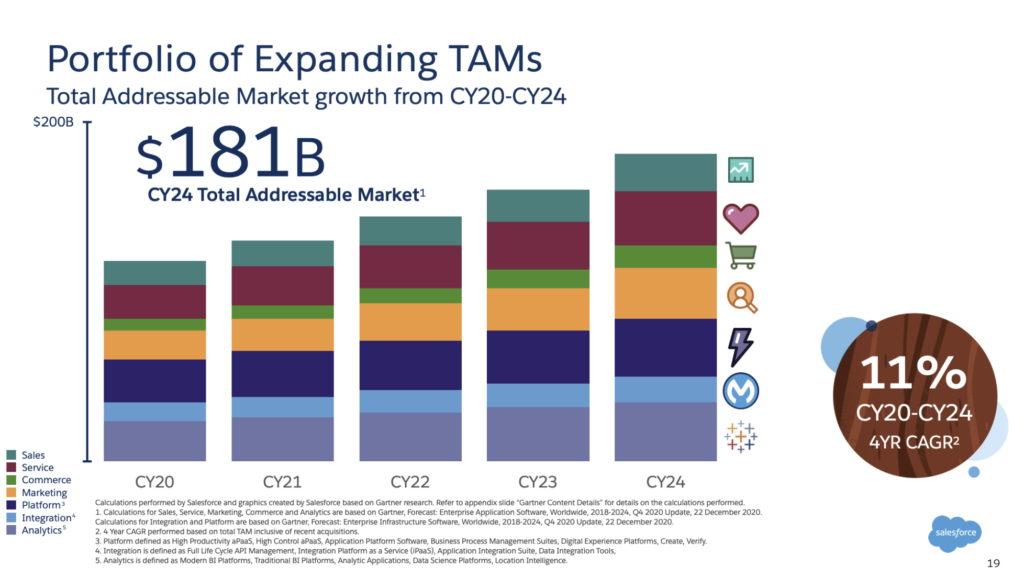

$181 Billion TAM Provides Runway for Growth

I see the multiyear trajectory of the TAM with an 11% CAGR as a promising runway for growth. However, I must throw caution that Salesforce will need to outpace the CAGR in all of its offerings to meet the ambitious growth rate that Marc Benioff has set for the company. With the target $35 billion by 2024 having been thrown out there, it would take growth close to 20% for the next three years to meet that objective.

The good news is that the opportunity is there with the company’s expanded TAM and the growth of demand for SaaS, however, it will take strong consistent performance for the next 12 quarters.

Overall Impressions of Salesforce Q4 Results

The results and longer term outlook are mostly positive for Salesforce. The company has some continued challenges in terms of keeping a growth trajectory that matches its ambitions, as well as integrating its inorganic investments; especially as the Slack deal closes.

I’m encouraged by the company’s focus on hybrid cloud, and its continued investment in platform. This high growth part of the business remains a key to its longer term growth, but I still want to see deeper integration of acquisitions like Tableau. I will be equally as inquisitive to see how the $27 billion slack acquisition can be efficiently returned to shareholders through sales, innovation, and intrinsic value.

Overall, it is growth all around. Salesforce is doing what Salesforce does in that capacity, and there is a lot to like about that.

Futurum Research provides industry research and analysis. These columns are for educational purposes only and should not be considered in any way investment advice.

Read more analysis from Futurum Research:

Juniper Commits Automatically to Experience First Networking Strategy

Microsoft’s 3 New Versions of Office Aim to Meet Customers Where They Are

Image: Salesforce

The original version of this article was first published on Futurum Research.

Daniel Newman is the Principal Analyst of Futurum Research and the CEO of Broadsuite Media Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise. From Big Data to IoT to Cloud Computing, Newman makes the connections between business, people and tech that are required for companies to benefit most from their technology projects, which leads to his ideas regularly being cited in CIO.Com, CIO Review and hundreds of other sites across the world. A 5x Best Selling Author including his most recent “Building Dragons: Digital Transformation in the Experience Economy,” Daniel is also a Forbes, Entrepreneur and Huffington Post Contributor. MBA and Graduate Adjunct Professor, Daniel Newman is a Chicago Native and his speaking takes him around the world each year as he shares his vision of the role technology will play in our future.