The News: Hewlett Packard Enterprise released its earnings results for its fiscal Q2 2021.

Q2 2021 Financial Highlights:

- Revenue: $6.7 billion, up 11% from the prior-year period or 9% when adjusted for currency with better than normal sequential seasonality driven by strong demand

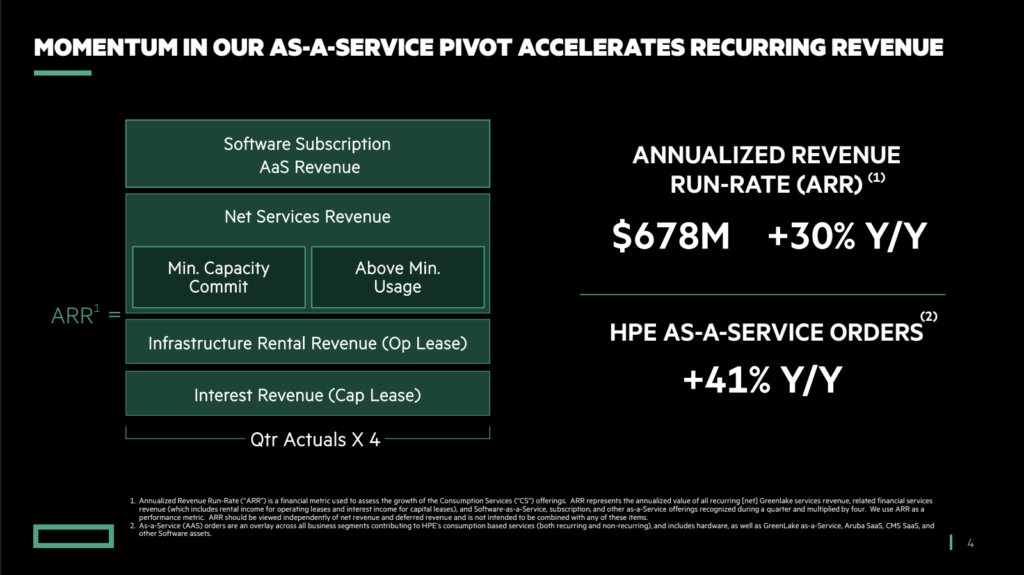

- Annualized revenue run-rate (ARR): $678 million, up 30% from the prior-year period

- Intelligent Edge revenue: $799 million, up 20% from the prior year period or 17% when adjusted for currency

- HPC & MCS revenue: $685 million, up 13% from the prior-year period or 11% when adjusted for currency

- Core businesses delivered revenue growth and strong profitability with Compute revenue of $3.0 billion, up 12% from the prior-year period or 10% when adjusted for currency and Storage revenue of $1.1 billion, up 5% from the prior-year period or 3% when adjusted for currency

Read the full earnings press release in HPE’s newsroom.

Analyst Take: The second quarter of its fiscal 2021 campaign marked a robust result for HPE delivering on both the top and bottom line and coming in just below double-digit top line growth (9%).

Following a return to growth for Dell’s ISG business and Cisco overall, I was expecting a strong performance this quarter from HPE, and the company delivered, with strength across most of its segments and overall growth that indicates the worst for on-premise infrastructure may be behind us.

Furthermore, HPE is in a significant transformation, moving aggressively toward as-a-service, and working ambitiously to shed the stereotypical business model of IT OEM’s and more toward consumption economics and service based offerings. This pivot has been steady, and perhaps not as fast as some may like, but it has been consistent and the trajectory upward, which I find encouraging.

As I see it, this quarter was an excellent result HPE. Let’s dive into some of the specifics.

ARR Growth as HPE’s Service Model Evolves

As I mentioned above, one key area that I was continue to watch each earnings period is the company’s Annualized Revenue run-rate (ARR). This number reached $678 million this quarter, equating to 30% growth over the prior year. With the company showing significant investment in its GreenLake business along with the roll out of new software services such as Ezmeral and Aruba Central, the company’s continued growth in ARR is an area that needs to be watched closely. Still, CEO Neri included in his recent securities analyst guidance that the company targets 30-40% compound growth of its ARR. This quarter’s outcome met the lower end of guidance, but also reflected an uptick from the 27% last quarter.

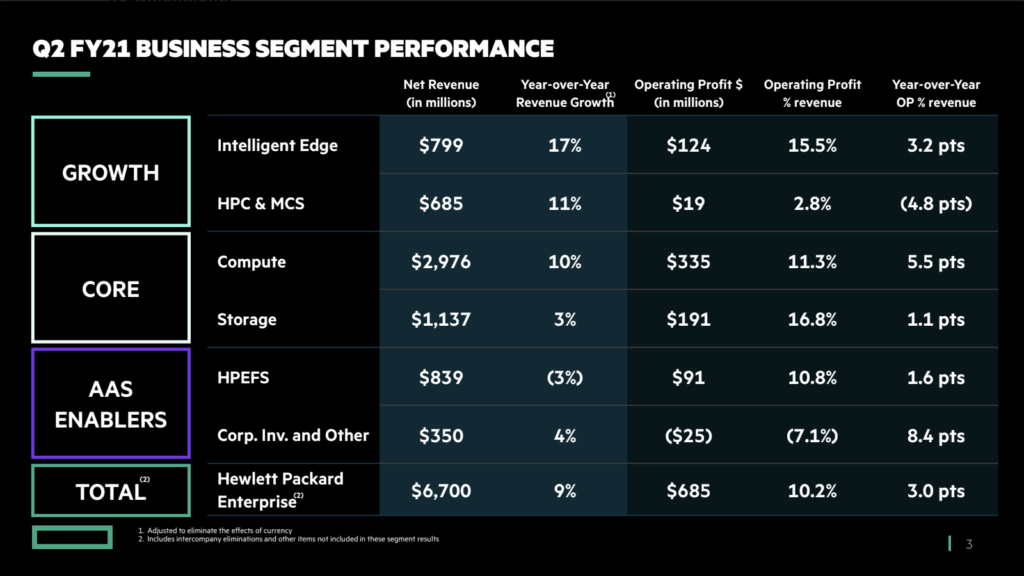

HPE Segment Revenue Sees a Big Uptick

The past few quarters saw retraction in many of the company’s key segments, but this quarter was much more encouraging with strong growth in several key areas and only financial services showing YoY revenue declines. Additionally, all the companies revenue buckets saw growth in operating profit by dollars outside of the company’s corporate investment/other category.

Intelligent Edge led the way in terms of growth up 17% YoY.

Compute, HPC, Storage all grew after having down results during fiscal Q1

Compute up 10% YoY

HPC showed a strong result up 11%

Storage up 3% YoY

Financial Services the only laggard coning in down 3% YoY

It was good to see key segments like compute and storage get back into growth due to their significant representation of overall revenue (~2/3).

Overall Impressions of HPE Earnings

This quarter marked undoubtedly the best since the onset of the pandemic, and the company followed others in its space which showed very good results. I was especially pleased to see how well diversified the revenue was, indicating the result was less cyclical and more of a preview of the bounce back for HPE.

Now I am looking to see this trend continue and similar growth outcomes in the company’s fiscal Q3.

Last quarter, I mentioned that the evaluation of companies like HPE, Cisco, and Dell tend to get conflated with hyper growth names like Zoom or Snowflake, and this is a mistake based upon the maturity of the business and the product and service mix. However, I do like to see these companies targeting recurring revenue, services, consumption, and cloud-like offerings as a method to future-proof for the long term. With some “Born on Cloud” type companies showing huge earnings and revenue beats, it is easy to forget that we are recovering from one of the most difficult sets of circumstances that the world has ever faced. HPE has showed resolve throughout a very tough year, and doing all of this while completely transforming its overall business. I continue to laud the company’s commitment to its strategy

It’s also important to reiterate that one of HPE’s benefits is that it is a diverse business, and a business in transition. Antonio Neri has not only relocated the company to Houston, but has been taking bold steps to change the identity away from high volume, low margin, hardware. I feel like I have said this for several quarters straight but it is critical to understand–This won’t happen overnight.

The increases in ARR and the strong growth of GreenLake continue to be encouraging and serve as leading indicators that the transition is working. Also, the operational efficiencies realized will help keep the company profitable AND in a strong cash position, which can be seen by the strong free cash flow generated YoY. Additionally, the dividend has been sustained, and the guidance was raised from $1.70-$1.88 EPS for 2021 to $1.82-$1.94 on a non-GAAP basis.

Key Point to Reiterate from HPE’s Q1 FY 2021

After last quarter, I said the following, and I say it again based upon my positive outlook on the company’s challenging, but imperative transition to everything-as-a-service:

The transition to an “Everything as a Service company is still going to take some time, and some investors struggle with that. What I do believe is that the changes are good for customers. And as it is often said, “what is good for customers, is good for business.”

Futurum Research provides industry research and analysis. These columns are for educational purposes only and should not be considered in any way investment advice.

The original version of this article was first published on Futurum Research.

Daniel Newman is the Principal Analyst of Futurum Research and the CEO of Broadsuite Media Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise. From Big Data to IoT to Cloud Computing, Newman makes the connections between business, people and tech that are required for companies to benefit most from their technology projects, which leads to his ideas regularly being cited in CIO.Com, CIO Review and hundreds of other sites across the world. A 5x Best Selling Author including his most recent “Building Dragons: Digital Transformation in the Experience Economy,” Daniel is also a Forbes, Entrepreneur and Huffington Post Contributor. MBA and Graduate Adjunct Professor, Daniel Newman is a Chicago Native and his speaking takes him around the world each year as he shares his vision of the role technology will play in our future.