The News: Adobe’s Q2 2022 earnings showed revenue surged 14 percent year over year to a record $4.39 billion, with revenue from Adobe’s Digital Media business accounting for $3.2 billion. Under generally accepted accounting principles, the company earned $2.49 a share. Shares slipped at the end of last week and again on Monday after Adobe reported revenue surpassed the street forecasts, but offered tepid guidance for the August quarter and full fiscal year. Read the full earnings report from Adobe here.

Adobe Q2 2022 Earnings Show Record Revenue Amid Revised Guidance

Analyst Take: Adobe’s Q2 2022 earnings delivered a solid set of results with a combination of growth across business segments and yet again delivered record top-line revenue. As the company continues to demonstrate, its multiple business segments, including Creative Cloud, Document Cloud, and Experience Cloud, can deliver growth. This latest set of numbers and the growth they highlight, show that Adobe is well-positioned to benefit from long-term secular trends and is continuing to deliver on the promise of its portfolio.

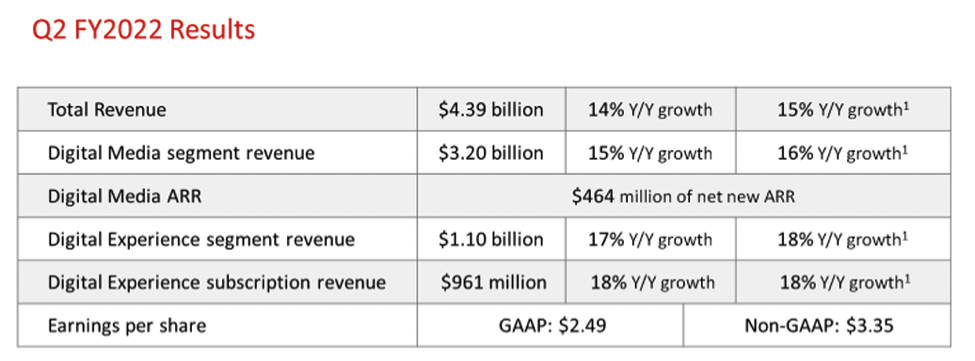

Earnings report details at a glance:

- Achieved a record $4.39 billion in revenue, representing 14 percent YOY growth. GAAP earnings per share for the quarter was $2.49 and non-GAAP earnings per share was $3.35.

- Digital Media business drove strong growth in both Creative Cloud and Document Cloud, achieving $3.20 billion in revenue.

- Net new Digital Media Annualized Recurring Revenue (ARR) was $464 million and total Digital Media ARR exiting Q2 grew to $12.95 billion.

- Experience Cloud business achieved $1.1 billion in segment revenue and $961 million in subscription revenue. Achieved net new Document Cloud ARR of $107 million and record revenue of $595 million, which grew 28 percent year-over-year.

Cross Portfolio Success

The performance of Adobe this quarter was robust and impressive in every area. While guidance has been a focal point for the investor community, as industry analysts we are keen to watch performance in key markets and solution adoption and satisfaction.

Adobe is seeing outsized growth in all of its categories and is seeing strength in winning battles for best-of-breed and point solutions through its more comprehensive portfolio. This has been the case in its document portfolio, creative portfolio, as well as Experience Cloud. In areas like real time data insights and offers, in CDP, Adobe’s offering has capabilities that are arguably unmatched. This should continue to be an advantage to the company as the market softens and the strongest companies with the right products and balance sheets win out.

Adobe’s Fundamental Outlook

The cross sector and overall topline growth in Adobe’s Q2 2022 earnings represent a strong performance for the company. This is encouraging for investors, especially considering how well Adobe is positioned for long-term trends and that most of the company’s revenue is ARR-based. We are at the early stages of the company’s focus on the metaverse and we continue to see upside potential from this diversification of focus. The revised guidance is obviously the news story of the day, but I believe it’s both explainable and also being over reported.

Guidance Worries Markets Unnecessarily

For the full year, Adobe now sees revenue of $17.65 billion, down from a previous forecast of $17.90 billion, with non-GAAP profits of $13.50 a share, down from $13.70 previously. The company listed multiple factors for the slightly reduced guidance, including higher effective tax rates tied to lower than expected tax benefits related to stock based compensation, and an anticipated $175 million drag from negative exchange rates in the last two quarters of the fiscal year.

Adobe Chief Financial Officer Dan Durn also outlined that the company’s full outlook was reduced by about $75 million due to the company’s exit from Russia and Belarus, and an approximately $12 million hit from a decision to automatically renew Ukrainian customers without charge. As I mentioned when covering the company’s numbers last quarter, this was not only the right thing to do, it also reflects well on Adobe’s leadership.

The other culprit of the lighter guidance was the impact of FX as the stronger dollar is having an impact on currency. This, like the Russia Ukraine issue, has been noted by several tech companies during the most recent reporting cycle and will likely remain for some time.

All the factors affecting guidance combined should have reduced the earnings outlook by 60 to 70 cents a share, but the company only actually reduced guidance by 20 cents, due to increased operational efficiencies. This is clearly reflected in Adobe’s guidance and it’s pretty clear the markets are overreacting to headlines.

Overall Impressions on Adobe Q2 Earnings

All in, Adobe’s results are on par with a peer group of enterprise and cloud software providers, which is to be expected. The continued strength of Adobe’s ARR across multiple product lines further solidifies the company’s position for the future. I will be continuing to look for a softening of ARR growth, but haven’t yet seen it. I remain bullish on the prospects for the company and only see an upside for the company’s investments in the metaverse as it is focusing on powering the creator economy.

Unsurprisingly, the conflict in Ukraine and the decision to pull out of Russia and Belarus was a slight drag on results. However, this should have been priced in given the early guidance last quarter.

I also see Adobe being in a great position to take advantage of some martech, analytics, and other document, metaverse, and unique point solutions being at risk as the market pulls back. Don’t be surprised to see a few strategic acquisitions or tuck-ins that could be both opportunistic and timely.

Overall, Adobe continues to impress both from an execution vision but also a humanitarian perspective.

Disclosure: Futurum Research is a research and advisory firm that engages or has engaged in research, analysis, and advisory services with many technology companies, including those mentioned in this article. The author does not hold any equity positions with any company mentioned in this article.

Analysis and opinions expressed herein are specific to the analyst individually and data and other information that might have been provided for validation, not those of Futurum Research as a whole.

Other insights from Futurum Research:

An Inside Look at Adobe’s Digital Economy Index – Futurum Tech Webcast Interview Series

Latest Earnings Report from Adobe

Image Credit: Shutterstock

The original version of this article was first published on Futurum Research.

Daniel Newman is the Principal Analyst of Futurum Research and the CEO of Broadsuite Media Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise. From Big Data to IoT to Cloud Computing, Newman makes the connections between business, people and tech that are required for companies to benefit most from their technology projects, which leads to his ideas regularly being cited in CIO.Com, CIO Review and hundreds of other sites across the world. A 5x Best Selling Author including his most recent “Building Dragons: Digital Transformation in the Experience Economy,” Daniel is also a Forbes, Entrepreneur and Huffington Post Contributor. MBA and Graduate Adjunct Professor, Daniel Newman is a Chicago Native and his speaking takes him around the world each year as he shares his vision of the role technology will play in our future.

Steven Dickens is Vice President of Sales and Business Development and Senior Analyst at Futurum Research. Operating at the crossroads of technology and disruption, Steven engages with the world’s largest technology brands exploring new operating models and how they drive innovation and competitive edge for the enterprise. With experience in Open Source, Mission Critical Infrastructure, Cryptocurrencies, Blockchain, and FinTech innovation, Dickens makes the connections between the C-Suite executives, end users, and tech practitioners that are required for companies to drive maximum advantage from their technology deployments. Steven is an alumnus of industry titans such as HPE and IBM and has led multi-hundred million dollar sales teams that operate on the global stage. Steven was a founding board member, former Chairperson, and now Board Advisor for the Open Mainframe Project, a Linux Foundation Project promoting Open Source on the mainframe. Steven Dickens is a Birmingham, UK native, and his speaking engagements take him around the world each year as he shares his insights on the role technology and how it can transform our lives going forward.