The News: Intel’s new Intel Blockscale ASIC (application-specific integrated circuit), its second generation bitcoin mining chip, was announced earlier this week in a market where momentum around blockchain continues to build. Blockscale ASIC is designed to help bitcoin mining companies achieve hash rate scaling objectives coupled with improved sustainability. Intel plans to ship its Blockscale ASIC to customers in the third quarter of 2022. Read the full Press Release from Intel here.

Intel’s New Intel Blockscale ASIC Focuses on Cryptocurrency Delivering Speed and Power Savings

Analyst Take: Intel’s second-gen bitcoin mining chip, the Intel Blockscale ASIC, is something that I believe is the right solution at the right time. Here’s why: there’s no question that the cryptocurrency trend has legs, and what we’re seeing here is affirmation that some of the largest businesses in the world want to play a role in the crypto ecosystem. But they need help in order to do that. In this case, Intel’s development of the Intel Blockscale ASIC is about providing that assist and helping some of the other largest businesses in the world ensure they are offering inclusive payments options for everyone.

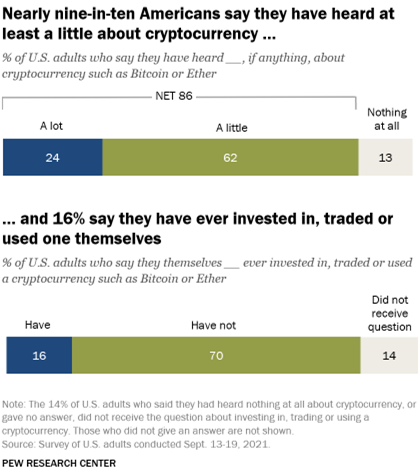

With major companies such as Microsoft, Overstock.com, Home Depot and others having strategies wrapped around cryptocurrencies, I expect the trend to continue to gain momentum. In fact, according to a recent study by Pew Research Center, at least 16 percent of Americans have invested, traded, or used cryptocurrencies.

As evidence of the growing interest in cryptocurrencies, popular payments platforms Venmo and PayPal started allowing users to trade crypto on their platforms in early 2021. In February of this year, the platforms further refined their processes, rolling out a new way to charge for crypto transactions its users make. It’s obvious that people are increasingly aware of the trend and also continue to explore other ways of paying for goods and services as global business-to-business and business-to-consumer marketplaces are on the rise. It makes perfect sense that companies are rushing to get on the crypto bandwagon they want to be where customers are.

Intel’s Blockscale ASIC

Intel’s new Blockscale ASIC will helps its customers achieve hash rate scaling coupled with improving ESG initiatives in the future. The Intel Blockscale ASIC includes a dedicated secure hash algorithm-256 (SHA-256) providing 580 GH/s (or 580 gigahashes per second hash rate) with 26J/TH (or 26 joules per terahash) which will speed up proof-of-performance and power efficiency. This is important since cryptocurrency mining is a complex mathematical process requiring miners the ability to find the right hashes in the shortest span of time. In addition, factors that impact profitability are power costs, efficiency of the network and prices of the cryptocurrency.

The Global Market for Cryptocurrency Mining Hardware

The global market for cryptocurrency mining hardware is large, expected to grow by $2.82 billion between 2021 and 2025, progressing at a CAGR of 7.85% during that period. It is expected to outpace IT spending and GDP growth rates over the next few years. From a cryptocurrency mining hardware perspective, many miners are leveraging ASICs due to their speed in finding blocks at a faster rate, which has translated into additional profits for them.

Intel’s Second-Gen Bitcoin Mining ASIC Chip is All About Energy Efficiency

In what is clearly an effort to increase speed and improve energy efficiency, Intel’s second-generation bitcoin mining ASIC chip promises to be more energy efficient in SHA-256 hashing for proof-of-work algorithms. Energy efficiency is absolutely essential for cryptocurrency miners and many are seeking regions and states that have not yet banned it, and are also seeking states with lower energy prices. For example, the United States has become a hotbed for cryptocurrency mining and states such as a Georgia, Kentucky, Texas, Nebraska, Wyoming and others are being incentivizing firms to build data centers in those areas.

As the Market for Crypto Grows, So Does the Need for Customized Products and Solutions

Wrapping it up, the market for cryptocurrency is expected to gain steam as an alternative payment method in the future and large and small organizations do not want to get left out of the picture. As an example, within the system builder market, I continue to see many reseller partners develop customized gaming, CAD/CAM, video editing and crypto mining systems which are higher-margin for them and expect those trends to continue. In addition, firms with larger data center operations will continue to seek products such as Intel’s Blockscale ASIC that helps increases energy efficiency which ultimately reduces variable costs in the future translating into higher operating margins. As I said earlier, I believe Intel’s Blockscale ASIC, is the right solution at the right time.

Disclosure: Futurum Research is a research and advisory firm that engages or has engaged in research, analysis, and advisory services with many technology companies, including those mentioned in this article. The author does not hold any equity positions with any company mentioned in this article.

Analysis and opinions expressed herein are specific to the analyst individually and data and other information that might have been provided for validation, not those of Futurum Research as a whole.

Other insights from Futurum Research:

Intel Foundry Services Fully Launches IFS Accelerator to Speed Up Foundry Customer Benefits

Intel Delivers Record Full Year Revenue and Beat in Q4

Image Credit: Intel

The original version of this article was first published on Futurum Research.

Michael Diamond is an industry analyst and foresight professional with 25 years of experience in the IT channel and market research industry. He is a route-to-market expert covering desktop and mobile devices, collaboration, contact center, ProAV, data center infrastructure, and cybersecurity. Prior to joining Futurum Research, Michael worked for The NPD Group as the sole industry analyst covering indirect channels, cybersecurity, SMB and vertical market trends, data center infrastructure (e.g., enterprise storage, servers, networking), ProAV and PCs. He has been quoted by media outlets such as Bloomberg, Kiplinger, TWICE, OPI (Office Products International), Apple World today, Dark Reading, Enterprise Storage Forum, Credit-Suisse, Footwear News, CRN (Computer Reseller News), Channel Futures and Into Tomorrow. Michael has presented at myriad events including The Channel Company’s Xchange, The Global Technology Distribution Council’s summit, SMB TechFest and more.