This research note includes analysis from Fred McClimans, Senior Analyst

The News: Dell Technologies reported first quarter results for fiscal 2022 after the market close on May 27, 2021, delivering both record revenue and adjusted earnings above consensus estimates.

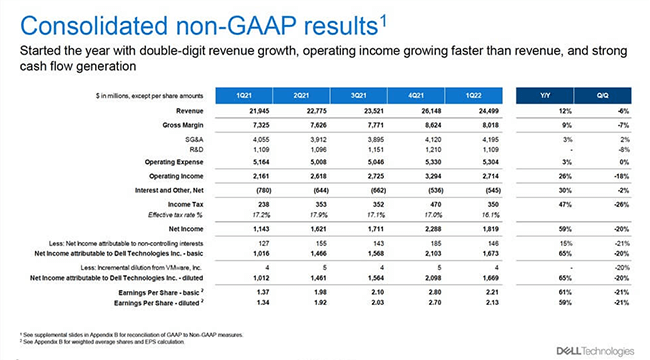

Here’s a quick breakdown of the key numbers vs. expectations:

- Revenue: $25.4 billion versus $23.4 billion estimated

- Earnings: $2.13 per share, adjusted, versus $1.61 per share estimated

This strong financial performance comes at a time when the technology sector is still facing significant challenges due to the recent pandemic. Read the full release on Dell’s Investor Relations Page.

Analyst Take: Dell’s strong financial Q1 2022 performance comes at a time when the technology sector is still facing significant challenges due to the recent pandemic, global trade issues, supply-chain disruptions, and rapidly evolving business and consumer behaviors. In this light, Dell’s performance is not only impressive but may also serve as a bell-weather for others in the sector.

Dell’s Q1 results not only beat consensus expectations but demonstrated the significant power of Dell’s growth engine over prior years.

Overall Growth

Overall quarterly revenues were up 12% YoY to $25.4 billion. While its gross margins held steady at 31% from the prior year, earnings rose 59% from $1.34/share to $2.13/share.

Revenue for both products and services across all business units were up, products by 12% year over year to $18 billion and services up 10% to $6.5 billion. This close 12% vs. 10% growth is important in that companies often rely on increases in services revenue to offset declining or slowing product revenue, which we do not see when comparing Q1 growth for 2022 with the 2021/2019 fiscal year results.

Business Unit Growth

Dell’s VMware business saw revenue increase 9% over the prior year to $3 billion — more about VMware in a moment.

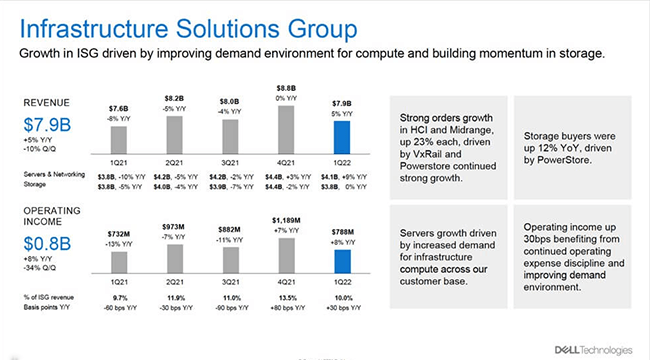

Dell’s Infrastructure Solutions Group (ISG) provides technology and services designed to help business customers digitally transform their organizations. ISG revenue was up 5% YoY to $7.9 billion. This includes a 9% year over year increase in its server and networking products revenue to $1.1 billion.

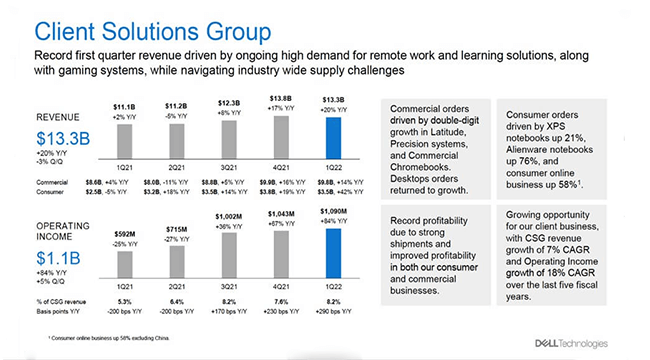

Dell’s Client Solutions Group (CSG) is where all of its computer, and related accessory, brands reside. CSG revenue was up 20% over the prior year to $13.3 billion. Both consumer and business revenue were up within CSG, 42% and 14% respectively, as was operating income, up 84% to $1.1 billion.

Overall Impression of Dell Technologies Q1 Earnings

Dell’s growth and financial performance is a direct result of its approach to both the market and its own strong execution. Dell’s management team has beaten expectations over recent years by narrowing its focus, or specialization, and has accurately anticipated the needs of the market two to three years down the road, really hitting it with its enterprise focus on cloud computing, storage, security, edge computing and IoT, and data analytics — all with a laser focus on the creation of value for its customers.

The company has provided some Q2 guidance, which is understandably a bit muted. Q2 revenue, in light of the VWware divestiture and supply-chain issues impacting personal computers, may lag an expected 6% Q1 to Q2 increase. Considering overall market disruptions, this is in line with our own expectations.

But Dell’s management team has created EPS value through growth, not cost-cutting measures. This while committing to pay down $16 billion of its roughly $42 billion in existing debt in 2022.

Dell Technologies Leverages Disruption to Opportunity

Dell has found new value and opportunity throughout the disruptions of 2020, benefitting from an increase in tech spend by consumers struggling through remote work issues and looking for tech-fueled outlets and entertainment. The company has also found a way to benefit from the acceleration in digital transformation initiatives by its enterprise customers who are seeking to adapt to an increase in digital customer engagements; support a suddenly remote workforce; and improve overall business agility and adaptability moving forward.

While many sectors and some tech providers struggled, Dell continues to overperform on revenue and earnings perspective – an overperformance that has the potential to continue for some time.

Dell’s Ace in the Hole, ISG and its Transformational Focus

Why is ISG such a big deal in Dell’s earnings? In a word, stability. Uptake of personal computers, laptops, gaming rigs, and the many other products that exist within CSG are subject to both seasonal and economic cycles. ISG, however, is geared towards providing support to its customers’ ongoing, and accelerating, digital transformation initiatives. While demand for CSG products can fluctuate considerably, demand for ISG technologies and services are considerably more stable and predictable, providing a balance to CSG’s potential fluctuations.

And while Dell along with an accelerated demand for PC’s to meet work/learn from home needs have shown that the demise of the PC market is clearly not as imminent as many had predicted, we would not be surprised to see ISG and its business transformation focus grow at a faster rate than CSG’s computer products.

Dell’s X-factor, the Uncertainty around VMware

I’m closely watching how Dell is evolving its business. It has a history of big acquisitions that often include the restructuring and divesting of assets purchased at a premium.

Dell’s plans to divest its VMware business should receive government/regulatory approval this calendar year. This is a good deal for Dell, VMware, and their mutual customers, in part this is because the divestiture is really one of paper only at this point.

The up-front value of this deal centers around Dell’s ability to generate over $9 billion in cash to help reduce the $42 billion debt still remaining from the EMC/VMware acquisition in 2016, as well as to allow Dell to focus more closely on its core branded products and services. But it’s important to note that this is far from a normal deal.

Dell Technologies may be selling VMware, but Michal Dell isn’t. Dell Technologies is essentially distributing its current 81 percent share of VMware, including a $9 billion one-time cash dividend to Dell’s existing shareholders, including Michael Dell and Silver Lake Partners (Dell’s financial partner), who will between them directly own and control over 50 percent of VMware. The real shift here is ownership from Dell Technologies to Michael Dell.

Dell has a history in shedding while retaining businesses, and you can look no further than SecureWorks for a great example. Acquired by Dell in February of 2011, Dell spun this cybersecurity company back out through an IPO in 2016. But Dell Technologies is still the largest shareholder of SecureWorks and has maintained a very close working relationship with the company. It’s very likely that the future relationship between Dell and VMware may be even closer.

Dell and VMware have an agreement in place allowing Dell to market VMware’s products for an initial term of at least five years, a stabilizing move for Dell and a smart move for VMware given that Dell generates a third of its overall revenue.

With Michael Dell controlling both Dell Technologies and VMware, it’s unlikely that either company would make a move that would be detrimental to the other for the foreseeable future and then some. But that doesn’t mean this deal isn’t without significant risk that could backfire if the transition negatively impacts business customers in any way.

The Forward Look

Dell Technologies is an iconic brand with impact well beyond the tech sector. While others are hedging, Dell is leveraging. While others focus on chip shortages, Dell says yes, it’s an issue but one we’ve anticipated and will work around for our customers. That’s a big deal in my eyes, the way Dell’s management embraces transformation and agility in their own business — and other companies would do well to learn from this example.

Dell’s own transformations over the past decades have not only defied conventional wisdom but have also allowed it to become a transformational leader for others. Its plan to drive high-value growth over the next three to four years includes a strict focus on products, solutions, and services involving hybrid clouds, edge computing, data management, telecom systems, and consumption-based infrastructure solutions that can be offered “as-a-Service” (APEX). I believe each of these areas is critical to enabling the future of business and look forward to more good things ahead from Dell.

Futurum Research provides industry research and analysis. These columns are for educational purposes only and should not be considered in any way investment advice.

Read more analysis from Futurum Research:

Dell Technologies Unveils Its Apex As-A-Service Portfolio

Dell Formally Announces Spin Off Of VMware Set For Q4

Dell Technologies Delivers Record Year Despite Covid-19 Pandemic

Image Credit: CRN

The original version of this article was first published on Futurum Research.

Daniel Newman is the Principal Analyst of Futurum Research and the CEO of Broadsuite Media Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise. From Big Data to IoT to Cloud Computing, Newman makes the connections between business, people and tech that are required for companies to benefit most from their technology projects, which leads to his ideas regularly being cited in CIO.Com, CIO Review and hundreds of other sites across the world. A 5x Best Selling Author including his most recent “Building Dragons: Digital Transformation in the Experience Economy,” Daniel is also a Forbes, Entrepreneur and Huffington Post Contributor. MBA and Graduate Adjunct Professor, Daniel Newman is a Chicago Native and his speaking takes him around the world each year as he shares his vision of the role technology will play in our future.