The News: President Joe Biden signed a first of its kind executive order on cryptocurrencies recently, directing federal agencies to coordinate their approach to the sector. To read the full Executive Order click here.

Breaking Down President Biden’s Executive Order Focused on the Crypto Sector

Analyst Take: As war wages in Ukraine, and the resulting economic de-platforming of Russia gathers pace whether through cutting the country off from the international payments network SWIFT or through corporations ceasing operations in Russia, the topic of how the world’s financial system operates is front page news. Against this geopolitical backdrop, the fact that President Biden decided that now is the time to drop an Executive Order focused on crypto is certainly not a coincidence.

Last week, Democratic Sens. Mark Warner, Elizabeth Warren, and Jack Reed implored the Treasury Department to provide guidance on how it intends to inhibit cryptocurrency use for sanctions evasion. The Biden administration purports that Russia will not materially be able to make up the shortfall from the loss of U.S. and European business by turning to cryptocurrency. White House Officials however were at pains to stress that said the Executive Order had been in the works for months and wasn’t a knee jerk reaction to Vladimir Putin’s invasion of Ukraine.

Roughly 16% of the U.S. population, or 40 million Americans and 43% of men ages 18-29, have reportedly invested in or are trading in cryptocurrencies, according to industry consensus. The Executive Order is not prescriptive on the provisions the administration wants agencies to adopt, or impose new regulations on the sector, but it does focus on six key areas. These include:

- Consumer and investor protection

- Financial stability

- Illicit activity

- U.S. competitiveness on a global stage

- Financial inclusion

- Responsible innovation

Consumer and Investor Protection

First and foremost, the role of government when it comes to financial oversight and regulation is to protect consumers, investors, and businesses. Against the backdrop what has become somewhat regularly occurring headlines around investors falling for crypto-based scams, or losing money through cyberattacks on exchanges or users themselves through such attacks as SIM swaps, protection for consumers is no doubt warranted.

The Executive Order outlined how the “unique and varied features of digital assets can pose significant financial risks to consumers, investors, and businesses if appropriate protections are not in place” and went on to suggest that “safeguards are in place and promote the responsible development of digital assets to protect consumers, investors, and businesses; maintain privacy; and shield against arbitrary or unlawful surveillance, which can contribute to human rights abuses.”

Many in Crypto circles would argue Crypto’s volatility is a feature, not a bug and that everything can be solved by having ‘diamond hands’ and HODLing. The Biden Administration obviously thinks differently. Drawdowns of 50% are not uncommon in the crypto space, with wild intra-day swings more the norm rather than the exception. If you look at this week as an example, on news of the Executive Order the BTC price rose to north $42,500 on some exchanges and has since dropped back down below $40,000 as of Thursday evening.

“The President has put forward a holistic whole-of-government approach to understanding not only the macroeconomic risks but also microeconomic, with the risk to each individual, investor and business that engages with these assets,” the official said. Investor protection is therefore a goal of Administration with part of this focus including understanding the technology underpinning digital assets.

I believe that the Biden Administration will largely be a spectator when it comes to controlling the market fluctuations of a non-sovereign global digital money such as Bitcoin, but enhancing protections at the on/off ramps into fiat is important if crypto is to become mainstream in its adoption.

Financial Stability

Against the macroeconomic and geopolitical backdrop that is 2022, the focus has shifted to topics that we took for granted even a few months ago. If I had said to you that the world’s 11th largest economy would be de-platformed from such networks as SWIFT and that the likes of ApplePay, Visa, Mastercard, American Express, and PayPal would cease operations in Russia even three months ago, you might well have questioned my sanity. But this is today’s reality.

Against the geopolitical backdrop is what I see as the desire by the Biden Administration to protect the United States and to seek to ensure global financial stability and mitigate systemic risk, and is a laudable endeavor. The sheer speed at which the Crypto world has grown from humble beginnings to public traded companies such as Coinbase has largely happened without the requisite regulations or supervisions. Many will argue that Crypto has had to operate within existing regulatory frameworks and companies such as Gemini have embraced the oversight. However, no one in the crypto space can argue that the regulatory frameworks are fit for purpose.

Crypto and Illicit Purposes

We have seen the rise of cryptocurrencies as the go-to option for many bad actors for the likes of money laundering, cybercrime and ransomware, narcotics and human trafficking, and terrorism and proliferation financing. While the tide has turned of late with the rise of firms such as Cipher Trace (recently acquired by MasterCard), providing essential capabilities to track down ill-gotten gains, issues still remain.

One area in the spotlight is that digital assets may be used as a tool to circumvent the United States and foreign financial sanctions. While not mentioned in the Executive Order, the subtext is that the position the United States has been able to establish since WWII with the dollar as the world’s reserve currency. The reserve currency status of the dollar gives the U.S. an unmatched position in the world when it comes to using that status as a weapon of war, that other countries simply do not possess. Many in Washington are only now realizing the power this affords them, and they will be reluctant to relinquish this power.

The need for robust anti money laundering and countering the financing of terrorism (AML/CFT), regulations are fundamentally important and only the most extreme of Bitcoin maximalists would argue otherwise. How the Administration will plan to work with jurisdictions abroad that have poor or nonexistent implementation of robust standards is not clear, especially as we see the global financial system bifurcate along West/East lines.

How the administration plans to regulate decentralized financial ecosystems, peer-to-peer payment activity, and obscured blockchain ledgers without controls is unclear and only time will tell when the agencies report back will the full picture emerge.

Crucially given the geopolitical landscape that has emerged over the last few weeks, the Biden Executive Order focused on the role of digital assets and how their use could undermine national security. Whether this focus was explicitly driven by the situation in Ukraine is unclear, but certainly, the recent hostilities have brought this issue into stark focus.

U.S. Competitiveness on a Global Stage

The Executive Order seeks to ensure the United States leadership in the global financial system. The U.S. has been at the forefront of innovation and technological advancement, which has underpinned economic competitiveness. The Biden Administration appears to be keen to see this leadership position remain through the responsible development of payment innovations and digital assets. The Executive Order outlines that “The United States derives significant economic and national security benefits from the central role that the United States dollar and United States financial institutions and markets play in the global financial system. Continued United States leadership in the global financial system will sustain United States’ financial power and promote United States economic interests.” It is hard not to draw a straight line from that sentence directly to the situation in eastern Europe.

Financial Inclusion

The role of financial ombudsmen or regulatory bodies is to ensure universal access to safe and affordable financial services. Even today, many Americans are underbanked and the worst affected are those who need appropriate financial services the most. Another area that is highlighted is remittances or cross-border money transfers where the costs place an unnecessary burden on those sending money home to relatives. How the regulators will look to resolve high profile cases such as the one against Ripple Labs and XRP will probably do more to demonstrate intent here than any reports that result from the Biden Administration’s efforts.

Responsible Innovation

The final catch-all focus area mentioned in the Executive Order is responsible innovation. While the focus on substantial implications for privacy, national security, and the operational security and resilience of financial systems, makes sense, I believe that the focus on climate change, the ability to exercise human rights, and other national goals represent a lofty ambition where regulators will struggle to make substantive gains. When set against the need for oil in a post-Russia world, the climate impact of crypto mining will be a hard case to regulate effectively, at least in the short to medium term.

Digital Dollar

Finally, it’s clear the Biden Administration also wants to explore a digital version of the dollar or more accurately a Central Bank Digital Currency. Last year the Federal Reserve began work on exploring the potential issuance of a digital dollar. The Board of Governers of the Federal Reserve System recently released a much-anticipated report detailing the prospects for the U.S. dollar in the age of digital transformation, but refrained from taking a position on whether it thinks the U.S. should issue one yet.

The U.S. is not the first to explore a CBDC, in fact far from it. China launched a CBDC trial at the recent Winter Olympics. Concerns are widespread on the rise of programmable money in authoritarian states as the potential for overreach by such governments in how CBDCs are allowed to be used are a real issue.

“Sovereign money is at the core of a well-functioning financial system, macroeconomic stabilization policies, and economic growth,” the order says. Again, given the geopolitical landscape and the overarching desire for the U.S. to remain a leader in the financial sector, researching, developing, and exploring the deployment of a CBDC is of the “highest urgency.” One potential benefit of a U.S. CBDC could result in faster and cheaper payments across countries’ borders, and the order calls for a report from agencies including the State Department and Homeland Security to weigh in on the future of money and payment systems.

While CBDCs could rapidly speed up the settlement of payments, policymakers are evaluating a number of issues around financial stability and privacy, however, the doubts remain, as evidenced by this sentence in the order, “should issuance be deemed in the national interest.”

What Was Not in the Executive Order: Stablecoins

One obvious omission from the Executive Order was the stablecoins. Stablecoins are digital non-sovereign digital currencies that are pegged to the dollar and backed by a basket of assets. Examples of stablecoins would be Tether, USDC, or GUSD. While policymakers have been keen to downplay any systemic risks resulting from crypto, there have been increasing concerns over the role played by stablecoins and recent high profile legal cases, especially those against Tether. Tether is the world’s largest stablecoin, with $80 billion in circulation, and has attracted the ire of regulators over claims its token is not sufficiently backed by dollars held in reserve. We are seeing increased transparency on the makeup of the level of backing behind Tether, with a recent attestation report providing more clarity.

As the various agencies report back in the coming months, I expect the omission of stablecoins from the Executive Order to be resolved, as it would be in my opinion folly to evaluate the crypto space and not include stablecoins in any meaningful exploration.

Is this a Watershed Moment for Crypto?

What does this Executive Order mean for crypto — is it a watershed moment? I don’t think it means all that much in reality. No new legislation, regulation, agency or government structure was announced, but how the news of the Biden Executive Order was received in the crypto community as a whole seemed almost as universally positive. All but the fringe Bitcoin maximalist crowd, who advocate for complete isolation of money and state, see the U.S. President acknowledging the crypto space and looking to regulate it as a positive thing.

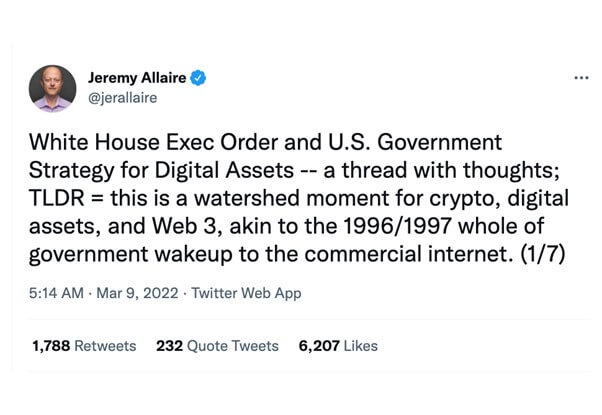

Net net, I believe a new policy agenda removes a key source of uncertainty for an industry that has already been rocked by numerous regulatory hiccups and scandals. So yes, perhaps it is a watershed moment. Jeremy Allaire, CEO of crypto firm Circle, certainly thinks so, posting the following on Twitter:

Crypto investors appeared to agree. Prices of bitcoin surged above $42,000 Wednesday on optimism over the U.S. executive action, however, those gains have largely dissipated as of Friday morning with Bitcoin back below $40,000.

My own perspective is that I see more certainty and regulation as a good thing for the crypto space overall, but, and this is a big but, that regulation has to be framed as enhancing innovation and providing a light touch set of guidelines and regulations that allow the U.S.-based crypto space to flourish. Overzealous regulations will have the opposite effect and could mean that the digitally native crypto developers take their laptops elsewhere and that innovation happens outside of the U.S.

Disclosure: Futurum Research is a research and advisory firm that engages or has engaged in research, analysis, and advisory services with many technology companies, including those mentioned in this article. The author does not hold any equity positions with any company mentioned in this article.

Other insights from Futurum Research:

Making Markets EP21: The Balloon Pops on Equities, Crypto and More as Tech Earnings Loom

Mastercard’s Acquisition of CipherTrace Will Bolster Crypto Capabilities

Amazon Exploring Crypto? The Cryptocurrency and Blockchain World Goes Crazy

Image Credit: Coincu News

The original version of this article was first published on Futurum Research.

Steven Dickens is Vice President of Sales and Business Development and Senior Analyst at Futurum Research. Operating at the crossroads of technology and disruption, Steven engages with the world’s largest technology brands exploring new operating models and how they drive innovation and competitive edge for the enterprise. With experience in Open Source, Mission Critical Infrastructure, Cryptocurrencies, Blockchain, and FinTech innovation, Dickens makes the connections between the C-Suite executives, end users, and tech practitioners that are required for companies to drive maximum advantage from their technology deployments. Steven is an alumnus of industry titans such as HPE and IBM and has led multi-hundred million dollar sales teams that operate on the global stage. Steven was a founding board member, former Chairperson, and now Board Advisor for the Open Mainframe Project, a Linux Foundation Project promoting Open Source on the mainframe. Steven Dickens is a Birmingham, UK native, and his speaking engagements take him around the world each year as he shares his insights on the role technology and how it can transform our lives going forward.