I may or may not buy things on Amazon on the regular. Forget that, let’s be honest: I am fully in on the Amazon Prime bandwagon and buy stuff all the time on Amazon. As a result, I am no stranger to packages piling up on my doorstep, and I’m also no stranger to the business of ecommerce purchase returns. I’ve noticed in recent months that Amazon is changing up the shipping game, and what fascinates me the most about this is that it’s yet another way the ecommerce giant is changing consumer behavior—without consumers really even noticing.

How Amazon is Changing the Returns Game

Here’s what I mean about Amazon changing the returns game. I had an Amazon purchase that I needed to return—chances are good you know the drill. For years now, when returning pretty much anything, not just Amazon purchases, the process has been that you do the return dance online with the ecommerce retailer, select the product(s) that need to be returned, print a shipping label, repack the item, then drop off at a delivery place. I have a neighborhood pack and ship store located a few blocks away, so dropping off “ready to go” packages there has long been my norm.

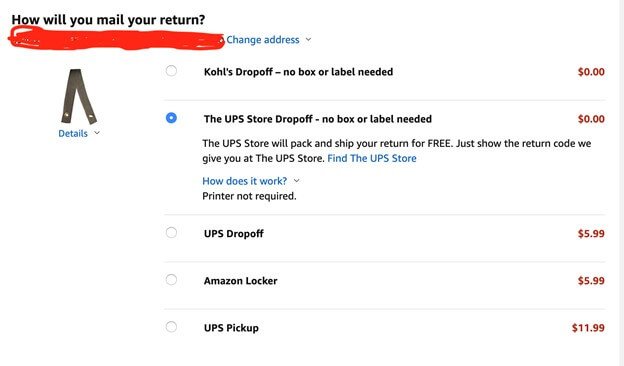

Recently, I had an Amazon return and instead of the normal procedures, got this prompt instead. Oh, look, change. Note the “no box or label needed” just take your stuff to a dropoff. Oh, look, there’s a Kohl’s dropoff now too — and that’s served up as a first choice. Subtle, Amazon, subtle.

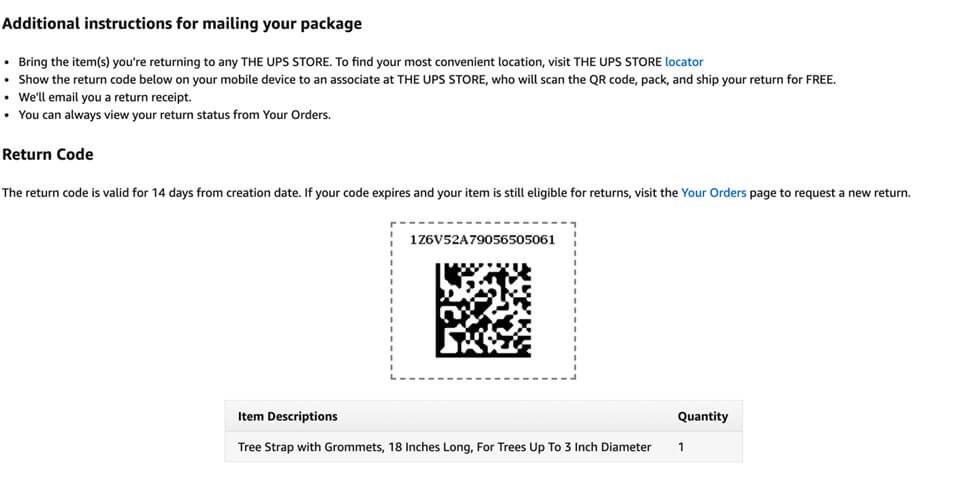

Here are the rest of the instructions you now get with an Amazon return. Also note there’s a limited time the return code is valid, prompting you to get on those returns.

When I took my return and return code to the UPS store to drop off, of course I asked about this because, curious. That, and I’m fascinated by how Amazon seems to constantly be changing up the game—with everything.

As we chatted about this, the UPS store owner advised that the new policies had just gone into effect (this was about the end of July for my market). He shared that all they did with these returns was to toss them into a gigantic box and send the box when full. No more individual packages, boxes, and the like. Just a whole bunch of returns, packed into one pretty large box, going to one destination. By the way, if you’re ever curious about what actually happens with Amazon returns, it’s not what you think. Here’s a recent CNBC article that’s pretty interesting: How Amazon is Redefining the Expensive and Wasteful Process of Returns.

Amazon’s Partnership With Kohl’s

This whole return business is fascinating. In fact, Forrester Research estimates that 25% of items bought online are turned, translating to some $207 billion in returned commerce goods expected this year alone. Which leads me to the role Kohl’s is playing with Amazon and the returns business.

Earlier this year, Kohl’s rolled the dice on an agreement to handle returns for Amazon at no cost to consumers. So far that gamble has paid off. Originally debuting as a pilot in a few locations, then rolling out to all of its’ 1,150 stores, geolocation foot-traffic analysis and anonymized credit card data showed a big uptick foot traffic at Kohl’s as a result. Big uptick to the tune of a 24% increase in the three weeks following the rollout of its Amazon returns program in July. And here’s the thing about foot traffic: Once you get people in your store to drop off a return, that’s half the battle. Chances are good they’ll take a minute to look around and, well, you know, buy something while they’re there. There remains a risk to Kohl’s as a result of this partnership, and time will tell how that will ultimately pay off, but it seems like a smart move to me.

Is Amazon Now Changing eCommerce Shipping Practices, Beyond Returns?

Returns are one thing, but how about that last-mile delivery of ecommerce purchases? Is Amazon changing that up as well? I think so.

Here’s how I know. A few weeks ago, I opened my front door one day to find one of those stickers from UPS directing me online to find information about a package. Irritating, because I office from home and if someone knocks on my door, I usually hear it and respond.

The visit to the internet that sticky note prompted told me that whatever amazing purchase was winging its way to me was waiting for me at — you guessed it — my neighborhood UPS store. When I went over later in the week to pick it up, I discovered there was nothing special about this purchase, it wasn’t too big or too valuable or too anything, it was just a random Amazon purchase that was delivered to the UPS store instead of to me directly.

Think about that for a minute. Imagine how much cost (labor costs, truck transport, gas, etc.) could be saved by teaching customers to GO GET their packages instead of expecting them to appear on their doorstops. It would also largely eliminate waste, as fewer items could be stolen by porch bandits.

I believe this is next on the horizon for Amazon—changing customer expectations and behavior such that we are going to slowly be trained to go get our stuff, rather than always have it delivered. Kohls, UPS stores, Whole Foods locations, lockers at local 7-Eleven stores (reported by a friend in the Colorado market) — it’s only the beginning.

Maybe you’ve noticed these subtle changes, and maybe not. Maybe they’ve not yet hit your market, but I think they will. With these changes, Amazon is changing the returns game in what is really a fairly small way, but it makes total sense. The customer still has to go somewhere to drop off a return—that is nothing new or different. But reducing the customer “work” involved and eliminating all the repackaging formerly required is smart and good all the way around. Especially from an environmental waste standpoint.

But mark my words, Amazon is not only changing the returns game. I believe we are the beginning stages of watching Amazon change up the delivery game as well. It’s a no brainer that it is cheaper for that last mile delivery to happen at one location (e.g. that local UPS store or other location) for a collection of nearby customers, instead of happening individually on doorsteps. That puts the onus on the customer to go get their stuff, and it also reduces Amazon’s costs substantially in the process. This will be interesting to watch.

Futurum Research provides industry research and analysis. These columns are for educational purposes only and should not be considered in any way investment advice.

Related content:

FedEx Cancels Amazon Contract — Amazon Sets Its Sights on Logistics Vertical

Amazon’s 2019 Hardware Launch: Quick Take on the 14+ Announcements

Amazon Web Services: Stay The Course, 37% Growth Is Absolutely Fine

Image Credit: NY Post

The original version of this article was first published on Futurum Research.

Shelly Kramer is a Principal Analyst and Founding Partner at Futurum Research. A serial entrepreneur with a technology centric focus, she has worked alongside some of the world’s largest brands to embrace disruption and spur innovation, understand and address the realities of the connected customer, and help navigate the process of digital transformation. She brings 20 years' experience as a brand strategist to her work at Futurum, and has deep experience helping global companies with marketing challenges, GTM strategies, messaging development, and driving strategy and digital transformation for B2B brands across multiple verticals. Shelly's coverage areas include Collaboration/CX/SaaS, platforms, ESG, and Cybersecurity, as well as topics and trends related to the Future of Work, the transformation of the workplace and how people and technology are driving that transformation. A transplanted New Yorker, she has learned to love life in the Midwest, and has firsthand experience that some of the most innovative minds and most successful companies in the world also happen to live in “flyover country.”